Previously, I covered 16 different types of investment vehicles. Three of them are known to be the best investment after conducting safety, liquidity and high-interest rate by investment and insurance corps. I would like to cover one of them, which is mutual funds.

What is a mutual fund anyway?

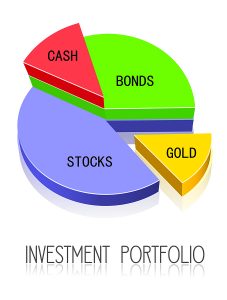

A mutual fund is a company that collect money from many investors and invests the money in securities such as stocks, bonds, and short-term debt and make more money, in another word, OPM (Other People's Money). As you know this is how any investments and insurance corps, and banks operate. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds.

*Shares represent the ownership of company's capital.

*The portfolio is diversified to minimize the risk and maximize the profits, instead of having only stock but keeping stock, bonds, gold and other securities to minimize risk. Basically, they don’t put all your eggs in one basket. Mutual funds typically invest in a range of companies and industries. This helps to lower your risk if one company fails.

Why do people buy mutual funds?

Mutual funds are a popular choice among investors because they generally offer the following features:

-Professional Management. The fund managers do the research for you. Those managers are human, not a machine. They are highly experienced and knowledgeable people, who manage your money to make more profits for you. What they do is to select the securities and monitor the performance.

-Diversification By diversifying a portfolio, they can minimize risk for you. Again the golden rule for any investment you don’t put all your eggs in one basket.

-Affordability Most mutual funds set a relatively low dollar amount for initial investment and subsequent purchases.

-Liquidity Mutual fund investors can easily redeem their shares at any time, for the current net asset value (NAV) plus any redemption fees.

What types of mutual funds are there?

Most mutual funds fall into one of four main categories – money market funds, bond funds, stock funds, and target date funds. Each type has different features, risks, and rewards.

-Money market funds have relatively low risks. By law, they can invest only in certain high-quality, short-term investments (short-term debt securities such as US Treasury bills and commercial paper)issued by U.S. corporations, and federal, state and local governments. Money market mutual funds are designed to offer features that are particularly suited to the needs of small investors. Minimum initial investments generally range from $500 to $5,000.

-Bond funds have higher risks than money market funds because they typically aim to produce higher returns. Because there are many different types of bonds, the risks, and rewards of bond funds can vary dramatically.

-Stock funds invest in corporate stocks. Not all stock funds are the same. Some examples are:

--Growth funds focus on stocks that may not pay a regular dividend but have a potential for above-average financial gains.

--Income funds invest in stocks that pay regular dividends.

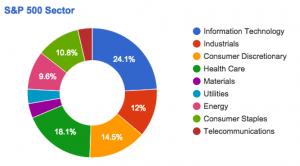

--Index funds track a particular market index such as the Standard & Poor’s 500 Index.

--Sector funds specialize in a particular industry segment.

*As you see, there is diversification done in the stock funds. Growth funds are designed primarily for the purpose to get profits from the buy and sell off a stock that has been increasing in price. For income funds, big corporations always expect to get paid regularly by having high dividends in the portfolio. Index funds produce 12% in average annually according to American Funds track record, it is the most reliable index in the U.S. to have in the portfolio. Lastly for sector funds, each industry performs differently, let's say some industry do great this year and some don't. Basically, sell a stock once it performs well and keeps a stock which performs badly until it does well.

-Target date funds hold a mix of stocks, bonds, and other investments. Over time, the mix gradually shifts according to the fund’s strategy. Target date funds, sometimes known as lifecycle funds, are designed for individuals with particular retirement dates in mind.

What are the benefits and risks of mutual funds?

Mutual funds offer professional investment management and diversification. They create threes ways to earn money.

-Dividend Payments. A fund earns income from dividends on stock or interest on bonds, although dividend's percentage can change.

-Capital Gains Distributions. The price of the securities in a fund may increase. When a fund sells a security (stocks, bonds) that has increased in price, the fund has a capital gain.

-Increased NAV (Net Assent Value). If the market value of a fund’s portfolio increases, after deducting expenses, then the value of the fund and its shares increases. The higher NAV reflects the higher value of your investment. For example, if a fund has assets of $50 million and liabilities of $10 million, it would have a NAV of $40 million.

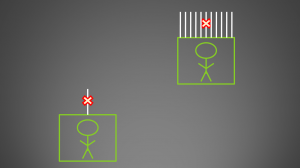

The most important consideration for people to buy mutual funds is a risk. As shown in the pic with elevator wires, you would lose all the money invested with having one stock in your portfolio if it's hit and fails in the business, however, mutual funds are different. It is designed to keep floating in the air even if one stock goes down because your money is supported by many other stocks. If you look at the past performance , it can tell you how volatile or stable a fund has been over a period of time. The more volatile the fund, the higher the investment risk. Mutual funds are proven to be low volatile.

Understanding fees

Running a mutual fund involves costs like any other investment vehicles, it costs to investors by charging fees and expenses. Fees and expenses can vary from fund to fund. A fund with high costs must perform better than a low-cost fund to generate the same returns for you. Even small differences in fees can mean large differences in returns over time.

For example, if you invested $10,000 in a fund with a 10% annual return, and annual operating expenses of 1.5%, after 20 years you would have roughly $49,725. If you invested in a fund with the same performance and expenses of 0.5%, after 20 years you would end up with $60,858.

All investments carry some level of risk. With mutual funds, you may lose some or all of the money you invest because the securities held by a fund can go down in value. Dividends or interest payments may also change as market conditions change.

<Recommend Book>

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition