A retirement plan is a type of investment. Investment plans are differentiated by the tax code, requirement and distribution . Most people struggle with choosing the best investment vehicle for their retirement because every situation is different. The difference in income, whether they own a business or not. This blog will differentiate the feature of common retirement investment plan. The most common retirement investment plans are those.

- Individual Retirement Arrangements (IRAs),

- Roth IRAs

- 401(k) plans,

- 403(b) plans,

- SEP-IRA plans, and

- SIMPLE IRA plans.

Let’s understand Pros and Cons of each investment and how tax code operates.

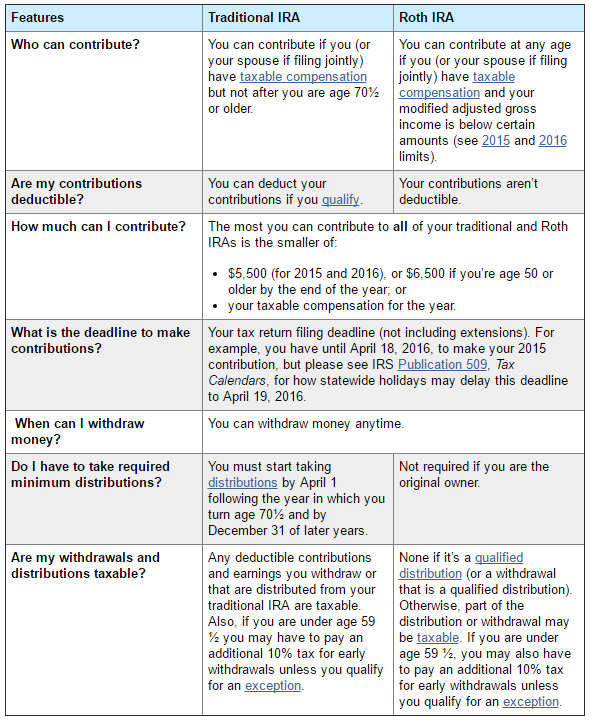

First of all, an Individual Retirement Account (IRA) is designed to help for anyone to save for retirement and offers many tax advantages. IRA has two types of retirement plan,Traditional IRA, and Roth IRAs.

IRA is basically the basket in which you keep stocks, bonds, mutual funds and other assets in it. It is an investment vehicle that runs by individual unit, unlike 401(k) running under a company. Roth IRA is also a retirement savings account that allows your money to grow. It has also tax advantage. There are many rules and different benefit attached to the each retirement account. Let’s compare the difference.

This is the copy from IRS(Internal Revenue Service) where you get always taxed from.

https://www.irs.gov/retirement-plans/traditional-and-roth-iras

If you are not familiar with the tax code and how investment operates, it wouldn’t be easy to understand all that because it took me years to understand the difference between all the investment vehicles. Honestly, it was overwhelming, I got to the point where I don’t really want to even think about retirement. Well, Here is the breakdown for you.

The Traditional and Roth IRA contribution limits are $5,500 for those under age 50. Persons age 50 and over can make additional catch-up contributions of $1,000, for a total contribution limit of $6,500. You can have both a Roth IRA and a Traditional IRA in the same tax year, but you can’t exceed the contribution limit with your combined contributions to both accounts.

*This is the most important part that I want you to understand how they exactly TAX you!!

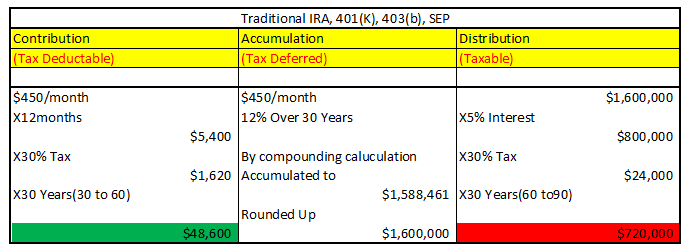

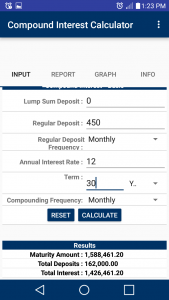

Let's say you decided to contribute $450, a total of almost $5,500 annually. You are not allowed to contribute more than what IRA says, IRA and Roth IRA are tax advantage compare to mutual funds, CDs, and all the taxable investment vehicles. Basically, for IRA, it is tax deferred, that means you get taxed later. The government would allow you to grow your money without paying any tax until you start taking your money out after 59 and 1/2. If you look into this, it sounds awesome, right? let's dig into the detail a little more to find out what they really are. For Roth IRA, it is designed to tax now and you can keep all the money later, meaning you don't have to pay tax on distribution phase. They both seem like great plans. Truth is...

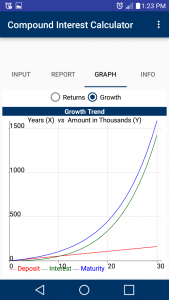

As the table shows, if you contribute $450 monthly with IRA, you can accumulate $5,400 annually and save $48,600 over next 30 years because the government says you don't have to pay tax now, pay later. So you get to grow your money to the point where it becomes $1,600,000 without being taxed, now you are ready to retire and starting taking the money out. You can keep the principle and live off of its interest which is $800,000 annually.The way, your money(principle) is not decreasing any. You can live the rest of your life, Financial Freedom!! However, take a look at the tax, you would be taxed $24,000 every year after you grew your money. Hypothetically, you live 30 years in your retirement. You would eventually pay $720,000 a total. That's right!!No wonder the government wants you to grow your money faster, because they can tax you more than $48,600. This is a significant difference. It sounds a scam, doesn't it?

For Roth IRA, basically, the opposite of tax differed, meaning you pay now which is $48,600 and keep $720,000 with the principle. It comes to growth, it would not be as much as IRA can do for you because you get tax constantly over 30 years. However, the difference is still significant. That's why IRS decided to put a cap on Roth IRA, basically, they cannot tax you if everyone starts running for Roth IRA instead of IRA. The number is not super accurate but here is the concept of how they work. Be wise and make a good decision!!

<Recommended Book>