This is the insider information, not many people are aware of the existence of Active management and Passive management. These are investment strategies that can be used to generate a return on people’s investment accounts. They differ in how the account manager approaches in the portfolio over time. Basically, Active managers are engaged in investing actively and paying close attention to market trends, shifts in the economy, changes in the political landscape and factors that may affect specific companies. They are watching your money all the time not to lose but focus on getting more return for you. Of course, investment fee can be higher than passive management.

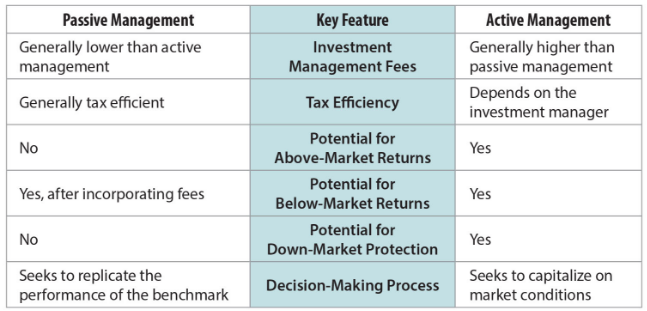

Passive management is the opposite of active management, which associated with mutual and exchange-traded funds (ETF) where a fund’s portfolio mirrors a market index. Passive management is to invest in index funds, which have historically outperformed the majority of actively managed funds. passive investing is not just about reduced activity, low fees, and tax efficiency as its name may infer. For example, 401(k)is a passive management account. If you have 401(k), as most people know what happened in 2008 and 2009 Lehman shock, tremendous people lost almost half of their asset and nobody could retire because of the loss. All the money accumulated over years of saving in 401(k) are half gone and forced them to go back to work. The catch is that no one calls your employer, or you to pull the money out. They kept the money in 401(k). They are technically not protecting your money at all because they are not watching your money. Here is the difference in management.

The concept of those strategies is that an active investor tries to “beat the market” on a risk-adjusted basis while a passive investor tries to “take the market return”. Probably the question you might want to ask is that which investment strategy is better? There are tons of debates going on over the selection, however, personally I rather want my money to be watched all the time to perform without losing even if I have to pay extra fees for it. Then I can enjoy the return of my investment without exposing my money to the negative market.

<Recommended Book>

Active versus Passive Management (Wiley Global Finance Executive Select)

One thought on “You Get What You Paid For, Active management & Passive management Investment”