It is confusing that there are many different types of life insurances and people don’t really know which one to pick. Many don’t want to even think about the difference, then ended up getting the cheapest life insurance, term life insurance. I would like to explain the concept and benefits of permanent life insurance as easy as possible and get into the details if necessary or requested to do so.

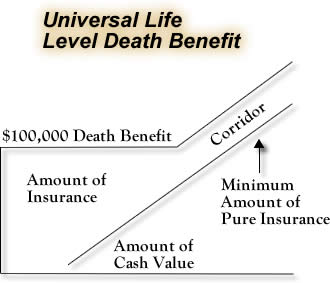

Universal Life Insurance (UL) is also known as Fixed Universal Life insurance. It is one of permanent life insurances that offers both a death benefit and fixed interests on your cash value. The excess of premium payments above the current cost of insurance is credited to the cash value of the policy. The cash value is credited each month with fixed interest, basically, you can accumulate your money in the life insurance. UL has a contractual minimum rate (often 2%-3%) although It can be differentiated by insurers. The pic below shows that once you grow your money in cash value to the same amount of death benefit, they both keeps on rising after that, that's how they keep your money from getting taxed. Shouldn't be exceeded the death benefit.

This is similar to CDs provided by Banks. I see many people keeping their money in banks due to the security. As I always mention, if you look for securities, Insurance corporations are the best places to be considering banks are backed by insurance corporations. First , the difference Between CDs and UL is tax advantages, CDs are taxable in its interest and UL is tax-free. Of course Tax –free is a big advantage. I hear many people concern about paying for the cost of insurance rather than a tax. Personally, I rather pay a cost of insurance than a tax because the cost of insurance is basically much cheaper than taxes and the increase of tax is inevitable in the future. If you are thinking about getting a permanent life insurance to protect your family and saving some money on the side, this is the product you want to have rather than separating CDs and getting another life insurance.

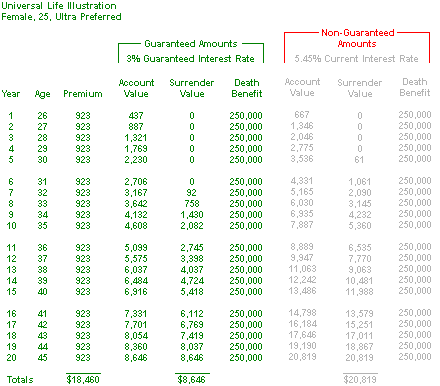

Another advantage is to have a long-term care on the policy. People eventually get old and unable to take care of themselves, some people say the otherwise but it is always great to have a plan in finances. Let's look at the illustration below. If you could access to UL’s death benefit which is $250,000 or more (eventually increase up to $500,000 as your cash value grow) to pay for your day care services and facility and medical expenses, your retirement would be more secured to pay for any necessary expenses.

People tend to consider buying a life insurance later 40’s or 50’s. However, as a financial professional, It is not very smart, you'd better buy a life insurance when you are younger and prepare for the future, yet you have no family at this point because the consequence is to force you to pay the expensive premium later. For example, I was talking to my father on the phone recently. He is in Japan. He belongs to the upper in a middle class. His entire life is working for a bank and dealing with loans and insurances. He has three children including myself and he has succeeded sending all of us to university and kept two houses. Considering that, he has a great financial stability income and experience and knowledge to make a great financial decision. He pointed out that if he knew how insurance works when he was younger, he could have saved so much money for the same benefits. I confirmed that as truth because it works exactly the same in the U.S.

As the illustration shows, this is how Universal Life Insurance works. If you kept UL for 20 years, you spend$18,460 for the contribution and the cost of insurance, and now you have $250,000 and the minimum of $8,646(Guaranteed) up to $20,819 cash to pull out. It is a great deal for what you paid for. Is it this something I recommend? Uhh....No.

*Truthfully, I like to have better interest rate than getting 2 or 3%. If you take a look at one of our blog “Effect of taxes and inflation(https://www.successfinancialfreedom.com/2016/08/18/the-effect-of-taxes-and-inflation)”, you are still losing your money with the lower interest rate in the long run. What are the better life insurances that can beat the benefit of Universal Insurance? What is THE BETTER life insurance?

There are two permanent insurances that can give you better credit with the same benefits according to the history, Indexed Universal Life Insurance and Variable Universal Life Insurance. Please look at the blog (https://www.successfinancialfreedom.com/2016/08/25/how-to-use-life-insurance-to-be-financially-secured/) for Indexed Universal Life Insurance and understand how this works.

<Recommend Book>

The Great Retirement Hoax: An Indictment of Universal Life Insurance (Traditional & Indexed), the Insurance Companies That Offer Them, and the Sa