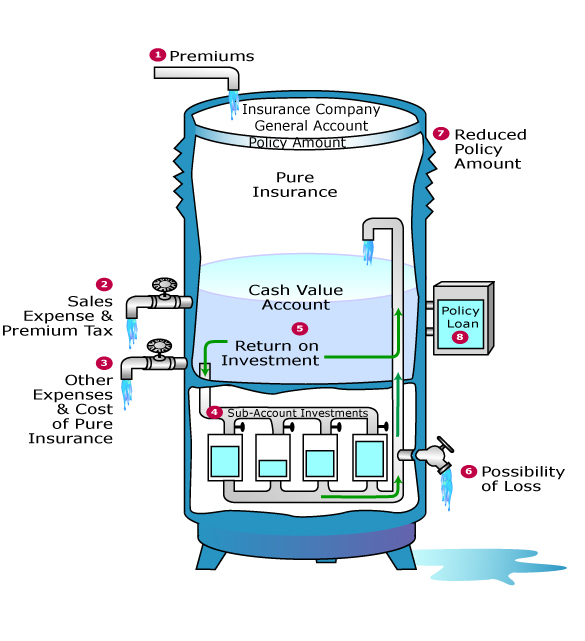

It is one of permanent life insurances that offers both a death benefit and an investment feature. The excess of premium payments above the current cost of insurance is invested and its return will be credited to the cash value of the policy. The cash value is credited each month with variable interests on your account. This is a comparable life insurance with Indexed universal life insurance. It is known to be expensive management fees and charge to manage the account. What is the truth of VUL?

VUL investment account includes subaccount, which functions very similar to mutual funds and exposed to stocks and bonds. So this exposure gives you the possibility of the rate of return and potential growth over a traditional cash value like whole life insurance and Universal life insurance. The performance of VUL is proven to be the best and credited compared to the other investment vehicles. VUL is truly made for someone who likes to watch the market and allocate investment funds. You have the choice to select from a wide range of investment options(fixed-income investment, stocks, mutual funds, bonds, money market funds, etc.) and the interest that your account earn to increase your account’s cash value.

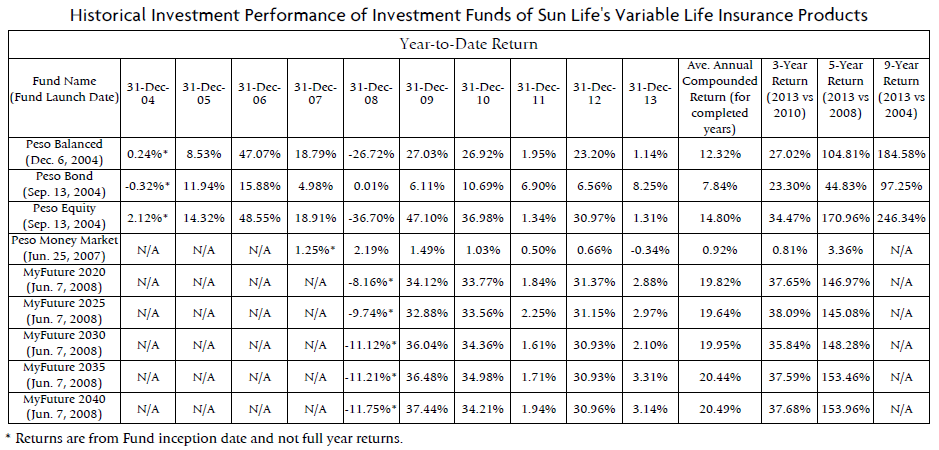

Professional money managers are watching your money constantly to manage. Thus your concern is the overall asset performance of the investment that you have chosen. Remember, your policy is still quite risky, your cash value and death benefits can fluctuate according to the performance of your investment portfolio. However, you can set a guaranteed death benefit, which won’t fall below a minimum amount even if your assets devalue dramatically. For cash value, it is never guaranteed; therefore, poor investment can wipe out your money out of cash value. If you take a look at the history of Sun Life’s Variable Life Insurance, what do you see? This is the quite impressive results. They show the performance that invested in the period of the worst economic crisis in 2008, they still got the return of over 100%(double of your principle) in 5 years.

VUL is a life insurance, however, You cannot buy it from life insurance agents because VUL is a security. The cash value inside a variable life insurance is tax deferred, it works just like 401(K), IRA and annuity, however, the death benefit is tax-free. VUL is controlled under active management, meaning your money is constantly watched by active managers but 401(K) and IRA are controlled under passive management (The difference between active and passive management:https://www.successfinancialfreedom.com/2016/08/25/you-get-what-you-paid-for-active-management-passive-management-investment/) My opinion, it is great to have an investment account to maximize profits like this, however, I would like to have a protection on my money if this is the savings for retirement. If you are curious about protected investment vehicle, check Indexed Universal Life Insurance: https://www.successfinancialfreedom.com/2016/08/25/how-to-use-life-insurance-to-be-financially-secured/

<Recommended Book>

Variable Universal Life

Get Paid to Write at Home!