When you hear qualified investment plans, that sounds good and safe doesn’t it? Some people may keep a qualified retirement plan without knowing what they are and do. I want you to understand that any investment called “Qualified” means that it is a type of retirement plan established by an employer for the benefits of the company’s employees. Basically, employers help employees to save their money, the way they can get the tax break in the contribution phase. In some cases, employers take their salary to contribute for employees to contribute to employee’s savings, it is a great company. However, there are tax consequences you have to understand. I explain this later using 401(K) as an example how a qualified plan works exactly, employees get taxed eventually. It can be a significant amount of money that you should concern about. That’s why some people call the plan “scam” and it has also many flaws to it.

Basically, qualified plans are broken down into two types, one is defined benefits and the other one is defined contribution. Defined benefit plans give employees a guaranteed payout and place the risk on the employer to save and invest properly to meet plan liabilities. A traditional pension is an example of a defined benefit plan, although currently, less than 15% of the private corporations provide. The pension plan used to be known as one of three legs supporting for retirement, now it is disappearing. (https://www.successfinancialfreedom.com/2016/08/29/3-legged-stool-for-retirement/ )

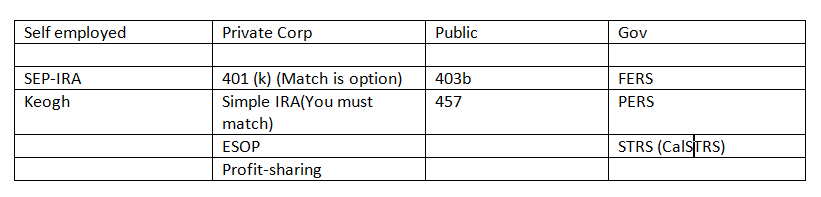

The types of qualified plans are those.

Qualified plans only allow certain types of investments, which varies by plan but typically include publicly traded securities, real estate, mutual funds and money market funds. Here is the point, I want you to understand that there are no such thing perfect investments out there, each investment vehicle has pros and cons and understanding your investment achieves you to have financial freedom.

Qualified plan 401(k)

The advantages of 401(K)

If you are a long-term investor planning to set up your investment account and keep contributing without drawing out any money until 60 or above, 401(k) and IRA may be good investments for you. 401(K) is very similar to IRA (Individual Retirement Account) which designed for individuals to save money for retirement. However, if compare with IRA, 401(K) has a few advantage to grow your money more than IRA due to the employer match-up. Employers match a portion of your savings for you, it is great because it is free money from corporations. For example, a company you work for has 401(K) plan and allow to match up 50% contribution.You could contribute up to 6% of your income, So if your annual salary was $35,000 and contributes 6 percent to the plan ($2,100), you would receive 50% on top of your contribution, which is an additional $1,050. It’s pretty hard to find a 50 percent return on any investment nowadays and the employer gets tax deductible. It is the win-win plan. Also, you won’t get taxed until your money get drawn out.

The disadvantages of 401(K)

On the other hand, there are some downsides for keeping 401(K) plan. First of all, you won’t be able to touch your money until 591/2 years and forces you to take a certain money out from 701/2, otherwise, you will be penalized (10% from federal and 3% state in CA and income tax on top of that). However, the amount of tax can be varied, it is really dependent on how much you pull your money because the government sees that as income. Let’s say if you have over $100,000 n 401(K) and decided to take all the money out at once due to the market volatility or emergency, you would get hit with 35% tax and penalty. It can be really painful!! You may think that if you keep your money until 59 1/2, and you can enjoy your retirement it would probably happen if there is no market volatility involved in your account. Find out the truth, here is the video provided for the fall out of 401(K). (https://www.successfinancialfreedom.com/2016/08/29/3-legged-stool-for-retirement/)

The other disadvantage is taxes. The more you grow your money, the more you get hit for taxes. This can be said the same for any qualified plan. The plan the government came up with is to letting you grow your money without taxing you in the contribution phase and once your money gets matured, it gets really hit with the incredible amount. This can be said the same thing to IRA and the other qualified plans. Of course, there are some solutions I would like to talk about at the other blogs.

<Recommended Book>

The 401k Owner’s Manual: The One They Couldn’t Put in Your 401k Enrollment Packet

Oh my goodness! a tremendous article dude. Thanks Nevertheless I’m experiencing situation with ur rss . Don’t know why Unable to subscribe to it. Is there anybody getting similar rss drawback? Anybody who knows kindly respond. Thnkx

Sweet blog! I discovered it while surfing around on Yahoo News.

Are you experiencing any tips on how to get indexed in Yahoo News?

I’ve been trying for some time but I never appear to arrive there!

Thanks