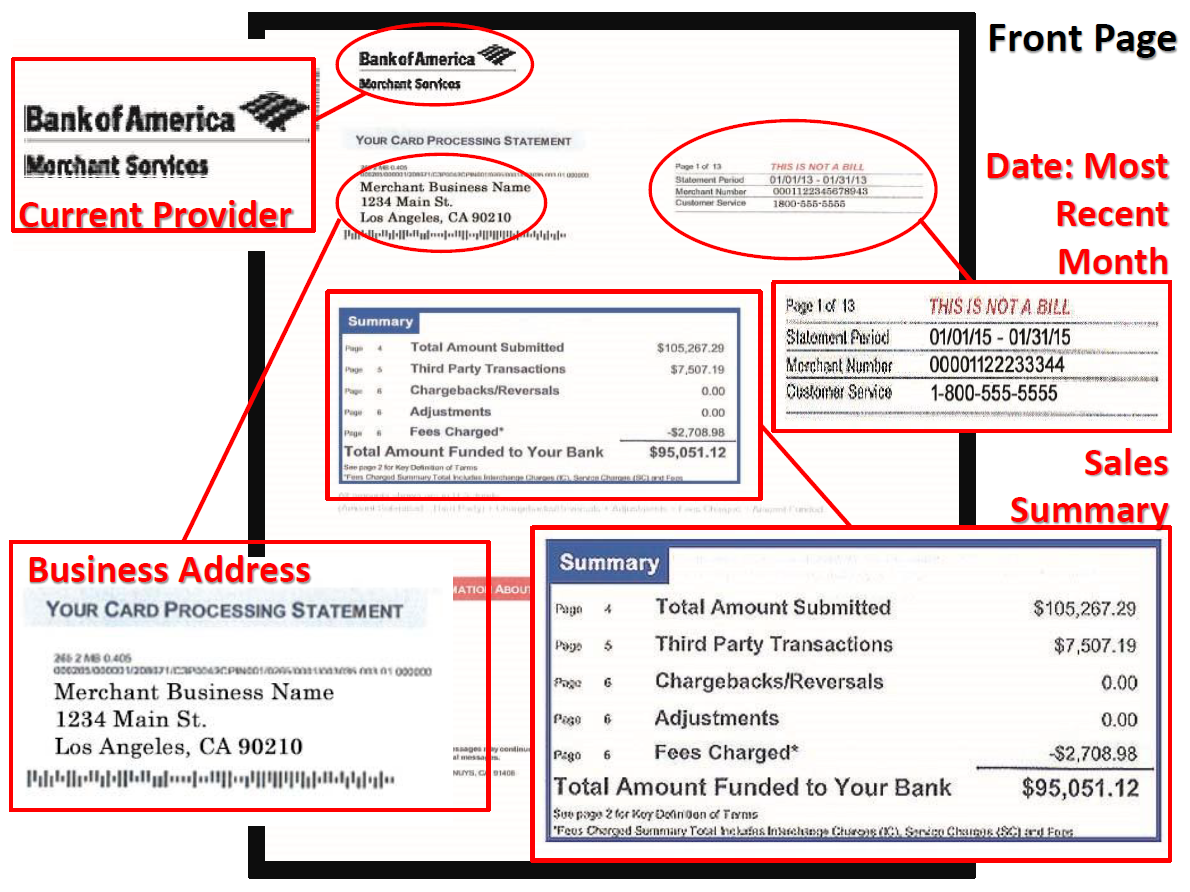

It is normal to carry the number of credit cards among consumers and swipe all the times at stores instead of cash. It is very convenient and addictive to use at anytime and anywhere and there is no fees or charges for consumers at all. It also provides the high security to protect credit card users from any sort of frauds. How about business owners which accept credit cards and pay for the credit card fees, bank fees and sale organization transaction fees? It sure has made numerous credit card transactions easy with customers. However, isn’t that charge and fees a little expensive? sometimes they cannot even make ends meet after many sales. That’s why there are many of small business owners like restaurants and some liquor stores are not accepting credit card use because of the ridiculous charge. Let me ask you this. Are you satisfied with the current interest rate? Getting a deal from a bank is not necessarily the great deal, in fact, sometimes they charge you so much money to rip you off. I want you to check the interests on the merchant statement you receive every month again. If it says 2.5%, and they said it is very low, you may be fooled because they only show their own fees, may not be including other fees ISO and credit card fees.

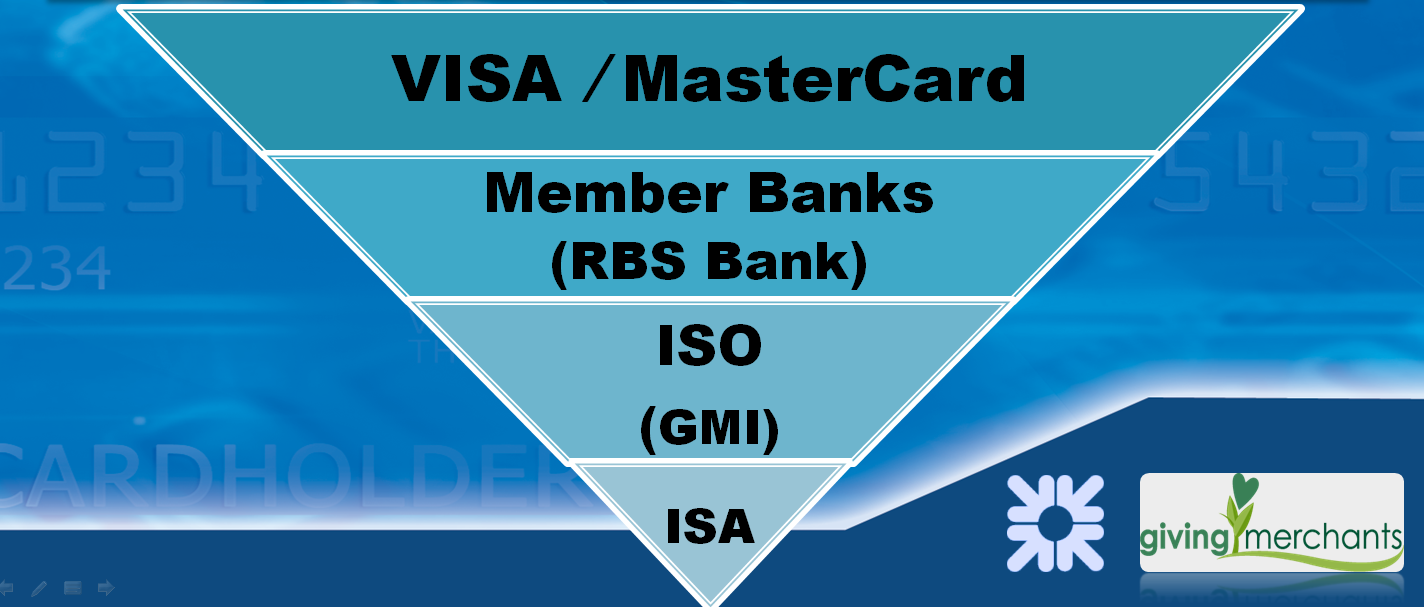

Let me show you the brief explanation of how fees consisted of.

VISA/MC gets 1.65%

Banks/ISO’s get .20%

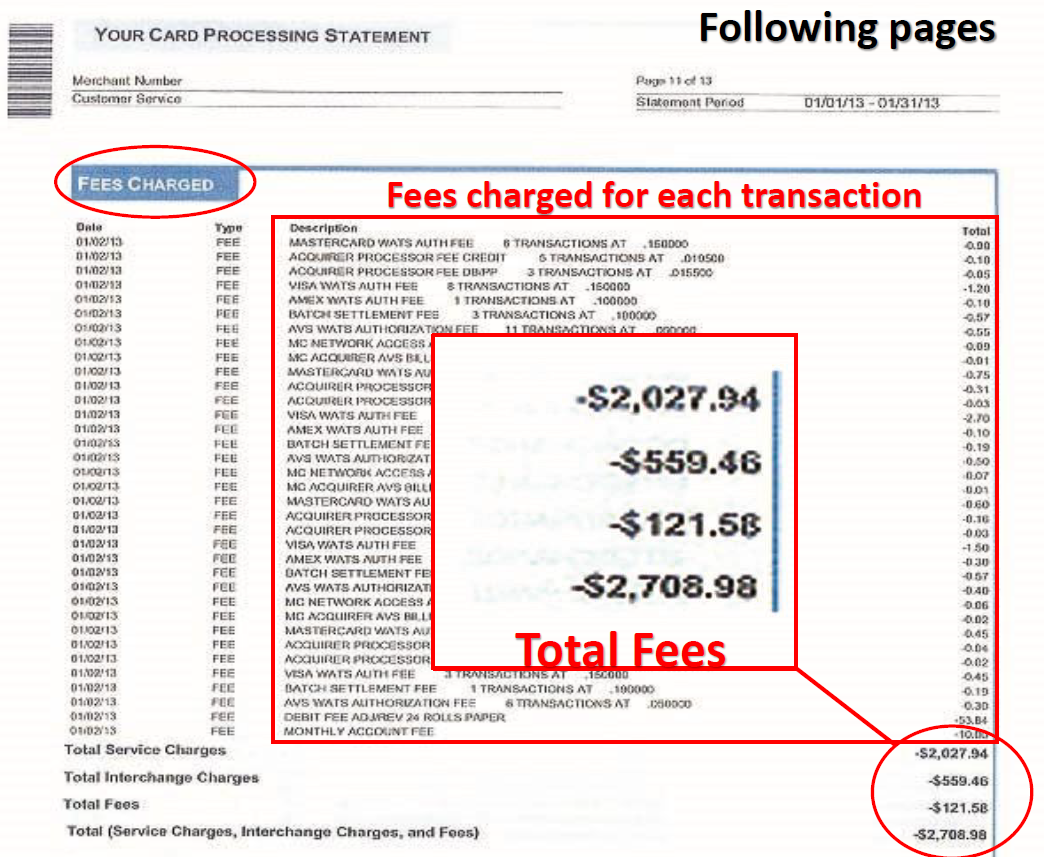

On top of that, business owners have to pay for the risk of transactions. The most common way for the use of credit card is swiping. They check your driving license, face to face and swipe your credit card at a purchase. It is the lowest risk transaction, meaning the cheapest transaction (1.85% – 2.99%). As the risk goes higher, the more they charge you for that such as a mid-qualified keyed transaction in which any transactions are done online or through a telephone, which means someone is punching the number in without identifying face to face like swiping. Those fees come on top of other less risk transactions. No wonder, many small business owners (ex, restaurants) pays so many fees, right? Sometimes they don’t accept corporate credit cards. Some business owners may hate you for that.

Swipe – Qualified – 1.85% – 2.99%

Keyed – Mid-Qualified – .99% – 1.99%

Corporate – Non-Qualified – .99% – 1.99%

Mileage/Rewards – Non-Qualified – .95% – 4.99%

We specialize in merchant services for small to large scale businesses. Let’s find out how much exactly you pay for unnecessary fees. Please contact us!!