Here is the continuation of “How a roll –over works 1”, the previous blog talks about what a roll over is and what type of roll-over exists and also the options of 401(k) and 403(B)roll-over. It may not be easy to understand right away for beginners but identifying your retirement account and your employment status is the first step to growing your money wisely without having any tax disadvantages or violating any IRS rules. Remember, not making any action also causes to have tax consequences, so please stay on the top of the game. The common and important roll-overs is this;

403(b) Roll Over To (another account 403(b), 401(K), IRA or cash out)

If you have 403(b) retirement saving plan, you probably work for public education organizations, some non-profit employers, cooperative hospital service organizations, or self-employed ministers. However, if you decided to change your job, you would have three options to continually save your money by switching to 403(b), 401(K), or IRA.

The possible option for you to switch your saving is to another 403(b). A new employer would be any of the organization mentioned above and it can be done easily. Please ask your new employer or the investment corporation behind a new employer to see the options. 403(b) can be transferred to another 403(b) even before the termination of employment. *This can be done during employment.

If you change your job to a new employer (a private corporation) which offers 401(K), you can transfer the funds to 401(K) to continually grow your savings. Please ask a new employer or the investment corporation that supports the employer to see the investment options. Basically, how 401(K) works and many rules attach to it is very similar to 403(b). Normally, a 403(b) rollover needs to be completed by the 60th day since you left an old employment. If the money is rolled over into another account in a timely matter, then meeting the requirements of this 60-day rule shouldn’t be problematic.

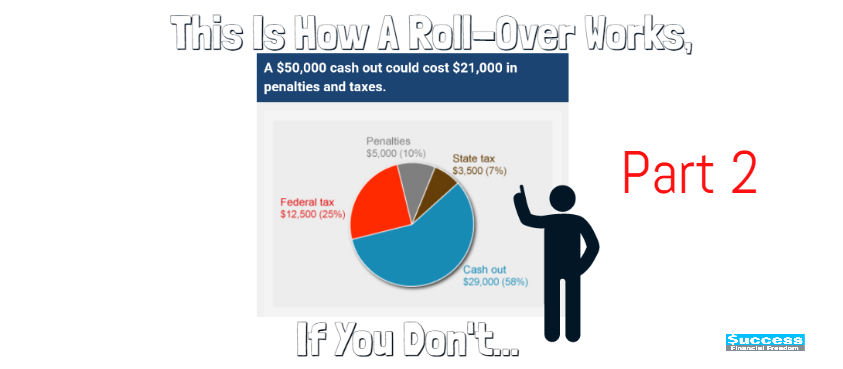

If you change your job but a new employer is not offering any retirement plan, you would want to enroll it to IRA, the way it will give you more control over your investment options, IRA tends to have lower fees and can ultimately hold funds from all of your previous work retirement accounts. Thus, it would be the best option for you. Lastly, you have another option to take the cash out of your 403(b), personally, I don’t see that as an option because as I mentioned at “How a roll –over works 1”, the consequence of doing this is very painful. Who would like to pay taxes for the government more than necessary?

[gview file=”https://www.successfinancialfreedom.com/wp-content/uploads/2016/09/rollover_chart.pdf”]

<Recommended Book>

The Rollover IRA Cookbook: Vanguard recipes for your old 401k (Investor Cookbooks.com)

I’m extremely pleased to uncover an excellent site.

I wanted to thank you for ones time for this reason wonderful read!!

I definitely really liked every bit of it and I

do you have book marked to view new things within your website.