We pay for Social Security Benefits from every paycheck you work for. This is what government does and how they tax you from your paycheck. Please make sure to get Social Security Benefits as much as possible.

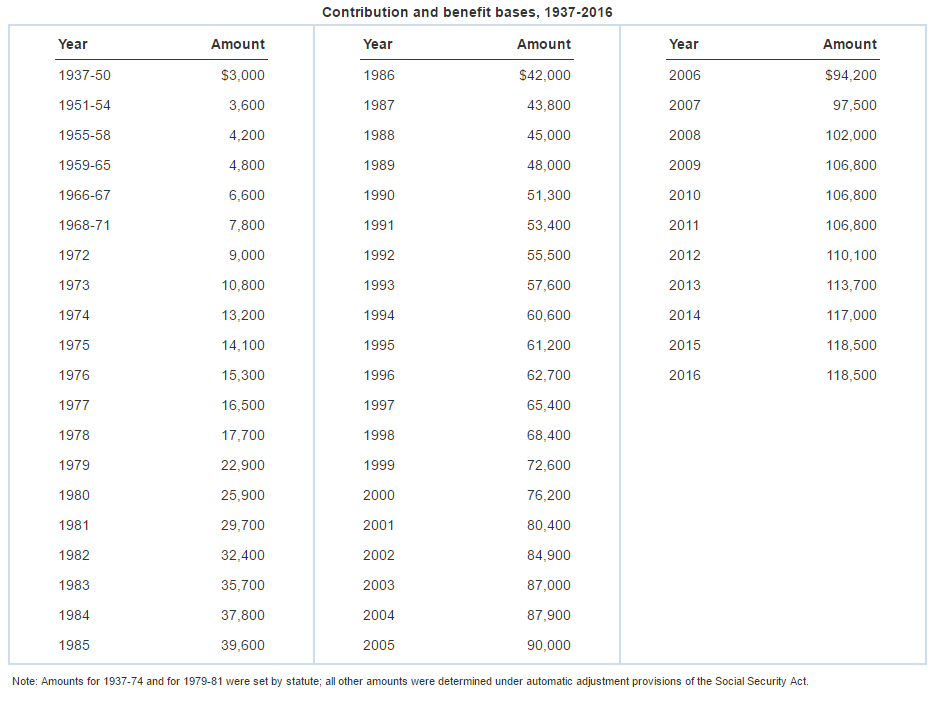

1. Social Security tax wage limit: $118,500

People pay 6.2% of their earnings in the form of Social Security taxes. Employers are also forced to match up with that amount out of their pocket to contribute the Social Security taxes. The same thing can be said for self-employed individuals, although a self-employed pay both halves of the taxes, adding up to a 12.4% rate.

Social Security taxes only applies up to a certain wage limit, and benefits are calculated based on those maximum taxed earnings, rather than your actual income for a given year. Each year, that number rises with the increase in the national average wage index, so 2015’s rise of $1,500 represents about a 1.3% gain from last year’s figure. As a result, the maximum amount of Social Security taxes that employees could pay will rise by $93 to $7,347 for those at or above the wage limit.

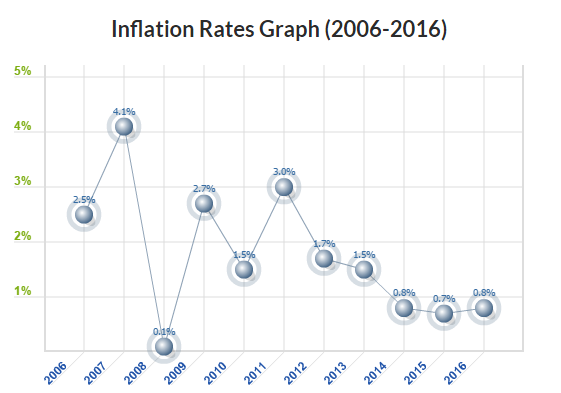

2. Cost-of-living increase for Social Security benefits: 0.8%

Social Security benefits are adjusted to reflect changes in the cost of living every year. Over the past year, inflation rose 0.8% which means this will effect on Social Security benefits to rise 0.8 % as well. This will take effect in January 2017.

3. Earnings required receiving one coverage credit: $1,220

To receive retirement benefits, you need to earn 40 coverage credits on the course of your career. Basically, you get 4 credits throughout a year, thus if you work for 10 years, you will be eligible to have social security benefits. However, this is the unknown fact about Social Security in order for you to earn full credit in a year, you have to make $4,880 or more to receive all the credits, then the government will them lock in your Social Security benefit eligibility.

4. Average monthly Social Security benefit for retired workers: $1,341

This is the biggest concern most people have in their retirement. The highest benefits they can have from Social Security is based on work histories that have the maximum taxable earnings for at least 35 years during a worker’s career.

The average monthly benefit received in January 2016. That’s up $13 from the $1,328 average of January 2015, reflecting both the 0.8 % cost-of-living adjustment and changes in the typical work history for those receiving benefits in 2016.

[gview file=”https://www.successfinancialfreedom.com/wp-content/uploads/2016/09/colafacts2016.pdf”]

Understanding the ins and outs of Social Security can make you plan your retirement securely. By keeping these simple numbers in mind, you can get the basics of what the program will give you when you retire and make sure you’re on course to get as much in Social Security benefits as possible.

<Recommended Book>

I really like it when people get together and share

ideas. Great site, stick with it! http://bing.net

Thank you for the comment!! Please stick with me. Thanks again.

Useful info. Fortunate me I discovered your web site by accident, and I’m stunned why this

accident didn’t took place in advance! I bookmarked it.