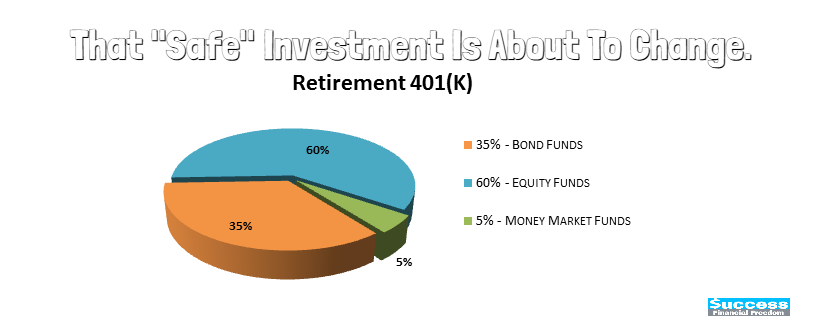

If there is a flaw in your retirement investment, it has to change to come up with a solution. 401(K) has been known as “Safe” investment many participants can rely on for the income in their retirement. 401(K) has been managed in money-market funds and other funds and act as cash equivalents. However, 401(K) is 100% exposed to the market volatility, that means you may lose all the money if the market crash like in 2008 and 2009. The tendency of the money management for retirement plans are becoming a blend of insurance and bonds. The insurance provides principal protection and a minimum guaranteed rate of interest instead of mutual funds. Then it can provide small and steady returns, along with principal protection. Now, new, more restrictive rules on money-market funds will be taking effect in October to changes 401(k) plan investment menus.

This is the news from CNBC, please continue to read!!

http://www.cnbc.com/2016/07/19/that-safe-retirement-investment-is-about-to-change.html

Questions to ask your employer

Ask your benefits representative or HR these basic questions about your money-market or stable-value fund:

-What is the interest rate?

-What are the fees?

-Can I lose money?

-How often does the fund pay interest?

-How often does it change the interest rate?

-Which company is providing the fund? How has that company handled different interest rate environments?

-Is there a market adjustment to the fund if the retirement plan wants to move the assets to another provider?

We can also find out for you.

<Recommend Book>

Money. Wealth. Life Insurance.: How the Wealthy Use Life Insurance as a Tax-Free Personal Bank to Supercharge Their Savings