This is another prediction I made recently on a stock that shows the successful movements last three weeks. My prediction went exactly what I thought it would be by following my theory "Time Principle".

Unfortunately, I was not able to buy this penny stock"IFMK" iFresh Inc because brokers, Ameritrade, E-Trade, and Charles Schwab restricted the purchase of the stock. I called each broker and waited for hours to set a limit but they didn't allow me to buy the stock. I know that this was available to buy until the end of Nov because I checked the restriction, however, they restricted trading afterward for some reasons. This is one of the upsetting things brokers do, they say that they restrict trading to protect investors, however, this seems to be obvious that they are protecting themselves from investors to prevent any loss. I happen to witness many occasions. Brokers start restricting the purchase of a stock when its chart starts showing an incredible opportunity based on the technical analysis. I really want to know who exactly restricts buying/selling stocks. They are really good at it.

Anyway, I was planning to buy the penny stock "IFMK" over the counter (OTC) on 3/23/2022. This is the screenshot taken on the day.

The chart is inverted below.

As you can see in the image, my theory indicated the near bottom. I expected it to go down to $0.0005 but it went down to $0.001 and turned around. This happened on 3/23/2022. The date to hit the bottom was spot-on and I would like to grade myself 100 points on that for entry.

My plan was to start buying the stock from 3/23/2022 and accumulate the number of shares over time because it takes time to fill a limit order for any penny stocks. It is difficult to make a single transaction to purchase at the bottom price anyway. What I usually do is divide my capital into three at least and start buying multiple times in the accumulation phase and average the purchase price to be near the bottom. Dollar-Cost-Averaging comes into play and becomes an essential part of my strategy.

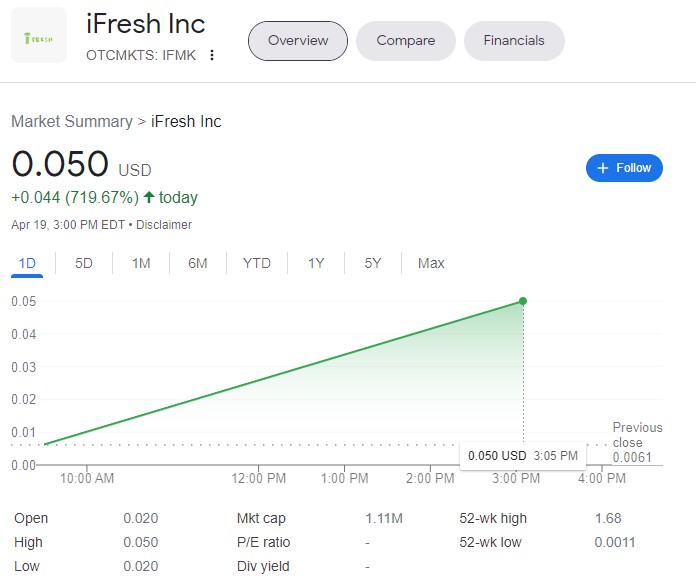

The image below is the chart taken on 4/19. As you can see, on this date the price went up over 700%. The previous close was $ 0.0061 on 4/18/2022 and now the market is closing it is almost 1:00 pm on 4/19 /2022 and quoting at $0.05, which is 719 % Up in one day.

The chart is inverted below.

The chart below is the standard orientation (Not inverted)

<Conclusion>

Time to buy the stock IFMK: iFresh Inc was a correct and spot-on prediction, I would like to give myself A+ on the time analysis. However, I was a little off on the prediction of the price. I predicted it to go down to $0.005 but it didn't, it hit the bottom at $0.0010 and bottomed out. So I can grade myself A- on that. In general advice, anyone could move the price and create a volatile environment if they want to, especially on low-volume penny stocks, thus, it would be smart to start accumulating shares days/weeks before hitting the bottom. Unfortunately, U.S. brokers didn't allow any investors to buy the stocks, IFMK although I am positive that there are some brokers, which can access the OTCMKTS: IFMK, provide a platform for traders to purchase the stock considering the fact that there are volume and moving the price from 0.0010 to 0.05 since 3/23/2022. The return is 50 folds in 4 weeks. My guess is that they are not U.S brokers. The lesson here, to secure a position of winning, you need to find a great stock that is quoting an extremely undervalued price and also be able to trade with an accredited brokerage that can allow you to trade and create enough liquidity to enter/exit the market.

I still believe that IFMK stock price will go up above $0.1, which is a 100 % return from the current price, $0.5. This needs to be followed.