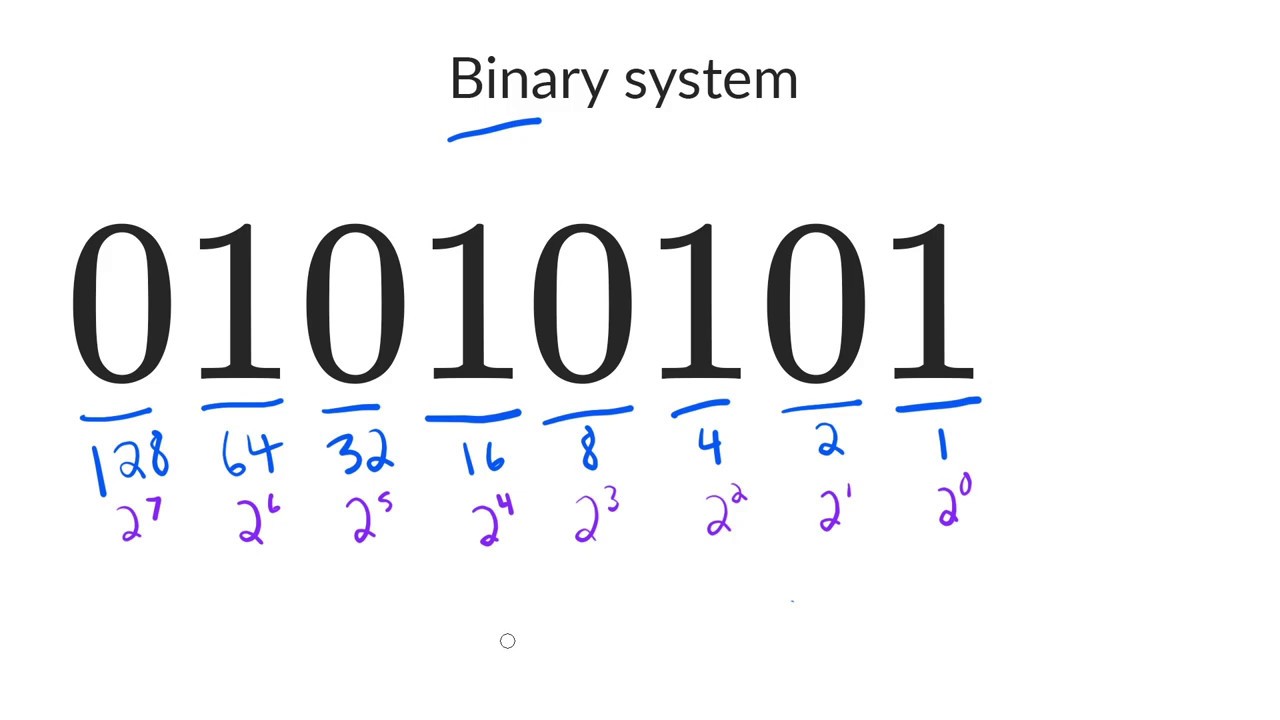

Let me explain how trading works clearly by using simple binary terms. In the trading world, if you want to keep this occupation as a job, you have to pick one or the other (There is always an exception).

If you want to be rich, you need to have successful trades. It is a decision and constant conscious behavior towards having successful trades instead of failed ones. You need to bid buy or sell because the market will either go up or go down. If you are right, you win. You made a good decision. If you are wrong, you made a bad decision. Then, you lose in trades and become poor. The consequence is to lose your job, no more trading.

To keep winning like Warren Buffett, you need to make rules whether "you do or you don't". If you are a short-term trader, you need to follow short-term trading rules, then you do not make long-term tradings. If you focus on long-term trading, you need to follow long-term trading rules, not short-term trading rules because they are different. Long-term and short-term trading are two different things. Sometimes, people intend to play short-term trading and switch to go with long-term trading after a significant loss, now he/she is hoping to win in long-term trading. This is a bad decision. This is the worst move any trader/investor could make because now you are not following the short-term trading rules. The consequence is that your capital is tied up with the losing trade, which leads to missing an opportunity. Since you do not know what you are doing, it is not different from gambling. What are the odds of winning? slim! You would more likely lose as a consequence. Short-term trading and long-term trading shall have different rules and shall not be mixed up together. If you are a short-term trader, you are a speculator. If you are a long-term trader, you are an investor. You need to stick to one or the other with certain rules and shall not deviate no matter what happens, that is the rule of thumb and discipline.

Whether the outcome is positive or negative, you have to accept the consequence and review your action whether what you did was right or wrong. To improve your trading, these are MUST things to do and then you have to rely on "indicators" and "risk management".

One of the trading indicators is "feeling" as long as you understand your feeling well and take action accordingly., you may be able to win trades. When you feel getting thrilled or excited, your bid is going well, you can tell yourself that your transaction is satisfactory, what you need to do is sell the winning stock and walk away with the realized profits. However, with greed, you decided to hold on to the it and hope to get more profits. The chance for the winning trade to become a loser is more likely, especially in short trading. It is a not soft peaceful job, it is a hard (cruel) harsh business. The advice is to stop being greedy and walk away when you feel good. If the price dropped, you start feeling fear or panic or even become angry because you didn't sell the stock when you felt thrilled and ended up having a loss on unrealized profits and principle.

If you cannot rely on your feeling, you can think instead. That is what I recommend you to do because it works very well. Instead of feeling the market to execute your trades, you could think and make a plan before you make any trade. To make a plan, you need to understand how the market works. You need to study the market, you need to understand yourself, and you need to reduce your blind spots. Your chance of winning would become much higher. If you do not study, you would be more likely to lose repeatedly and become broke. Feelings are not a reliable indicator. Feelings change all the time. Feelings are difficult to be observed objectively. For instance, if you are hungry, you tend to have short temper, and then you would tend to make quick and wrong decisions, and make the situation worse than it is. I do not want you to execute trades based on your feelings. I see many males on Wall Street. Many successful traders have a great mind and think things logically. I believe that males have the tendency to think things in a logical way than females do and became survivors. This may be a biological difference but it sure does affect how to think and behave in the market. In this harsh competitive world, you either die or survive.

To become successful, you need to build capital gradually instead of destroying it by having a number of successful trades. To prevent destroying your account, you need to do well in risk management. If you do not, you will lose sooner or later. Then you become a loser. If you do well, you may lose temporary but you are sure to get ahead of most traders eventually.

Trading is not an easy occupation rather difficult, however, you do not need to be smart to win this game. You can definitely win the game even if you are stupid as long as you follow successful rules and keep discipline. You do not need to be old and knowledgeable to confront the market, you can be young and win trades constantly by understanding how the market works. Whatever you do shouldn't be accidental, it has to be intentional and controllable. You cannot control the market but you can control what you think and your actions. In the end, your handsome profits would follow nicely rather than having ugly losses. I do not want you to play the market when it is hot, the market would be very volatile and you tend to lose money quickly because you tend to react emotionally as the chart moves rapidly. You may be able to make money fast, you would lose everntually. I recommend you to play in the cold market with a well-throughout-plan and a probable winning strategy. If you trade "in/out" continuously to scalp the movement of stock price, the chance is more likely to lose in the long run. I know some people do well scalping but less than 1 percent is able to survive the strategy. Minimizing the number of transactions is the key to maximizing your capital.

Again, the market is a cruel harsh environment it is not a nice and kind place. It can destroy your account one day even after accumulating millions of dollars. You need to have odds on your side to maintain winning. You can like or hate the market but I am sure that the market does not care. You need to protect your account no matter what it takes from losing. Gain or loss on your account is 100 % your responsibility. You need to think well, do what you need to do to make the right decision, and create a positive outcome to make sure that you are always up and maintain winning. This way you could be rich and successful in the long run. This is the only way.

Rich/ Poor

Success/Fail

You Do/You Don't

Up/Down

Right/Wrong

Right/Left

Yes/No

Positive/Negative

Win/Lose

Think/Feel

Mind/Heart

Good/Bad

1/0

Truth/False

Forward/Back

Alive/Dead

Strong/Weak

Smart/Stupid

Build/Destroy

Buy/Sell

Hot/Cold

Difficult/Easy

Handsome/Ugly

In/Out

Like/Hate

Import/Export

Intentional/Accidental

Presence/Absence

Past/Future

Open/Close

Tall/Short

Full/Empty

Kind/Cruel

Top/Bottom

Gain-Loss

Young/Old

North/South

West/East

Polite/Rude

Public/Private

Push/Pull

High/Low

Morning/Night

Temp/Permanent

Peace/War

Soft/Hard

Slow/Fast

Small/Large

Sharpe/Dull

Male/Female

Day/Night

Light/Dark

One thought on “Trading Is Binary System”