Crude Oil hit -(negative)$40 right after COVID 19 brought us the global public health emergency, Pandemic on 4/20/2020. S&P500 (SPY) hit the bottom at $218 on 3/23/2020, this was around the spring equinox. Everything went down quickly and made the fastest drop in the U.S. history 36% drop in 36 days.

Interestingly enough crypt industry was not really lined up with the general market as a whole since the crypt market was still on the way up and hitting its peak around the time. Of course, it dropped quickly around 3/20/2020 as well as the general market but it came right back up and jumped around 43,000-58,000 (BTC) around the time. Eventually, BTC hit the peak $69,000. However, the point is that one thing common among these markets, S&P 500, NASDAQ , DOW, many commodities, and crypt, these markets were about to make one more last strong bullish wave starting from 3/20/2020. Usually, the last wave is recognized as a fast movement and known to be the most profitable time period of a bull trend. During this time period, people become insanely optimistic and lose their rational minds to the point they do not care about the value of the market, which is the foundation of the market. This was addressed in the previous blog using the example of TSLA stock value.

For instance, amateur traders came into the market without having sufficient knowledge and experience and start making money. Getting attention on Instagram or Facebook and telling people that "I quit my job and started momentum trading, now I make more money than my last job". Everybody starts trading and playing with money at the time and it immediately caused the market to get heated up very quickly. Trading/investment brokerage becomes busier than ever to cope with the demand. I am certain that Coinbase and Robinhood must have taken advantage of the situation very well at the time. The Robinhood platform was designed to lure people in casually and have them trade like a game. A good example of supply and demand.

The characteristic of the last wave is very fast, rapidly moving upward and tremendous money starts flowing into the market (stock, crypt, and commodities) without having any rational reason and continues with momentum for a little while. If you try to bet against this type of wave to make profits, you may lose a big time. For example, as you probably know, this event collected quite an attention as Melvin Captial Fund shorted GameStop (GME) in Jan 2021 and lost 53 % of its fund approximately $6,800,000,000 in a month. This was a typical boom-bust pattern and Gabriel Plotkin became a victim of betting against the boom.

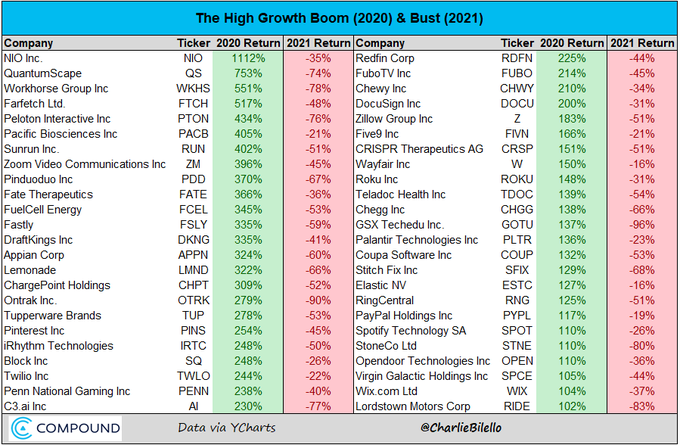

Many people enjoyed riding the last wave and accumulated money in a short period of time. BOOM on crypt currencies, GME, AMC, TSLA, APPLE, NVIDIA, AMZN, and small-cap and even OTC stocks. Many stocks including Chinese stocks boomed as shown in the image below. Everything went up, up, and up for a year from 3/20/2020-3/20/2021.

I would like to bring it up specifically the topic of the time period that lasted for a year for the majority of stocks some other time but the point is that people made money without working, without knowing its market characteristics. Remember, the market is the most competitive, bloodshed, and brutal place you can find in the world. If many amateur traders start making an incredible amount of money. You would probably want to step back and remind yourself "Something is not right" and it is far from what normality looks like. You need to understand that the movement of the market is not normal, it is an abnormal time period backed by a sustainable movement since the movement was purely driven by speculation. If you look back and analyze how the economy responded, you should be able to reach a reasonable conclusion. The U.S. market was being pushed up by stimulus checks internally due to COVID-19 although the economy was not as strong as pre-covid 19. However, the printed money boosted the economy without maintaining its robust financial/economic foundation. I would like to call it a ticking bomb...

Frankly, I do not care WHY and HOW it happened the way it did. Many economists trying to figure out, and connect the dots to find the cause and effects of the market movement and then predict the future movements and economic direction. In my opinion, It is wasting time and not productive in regards to predicting the future market movements since every event is different, and almost impossible to pinpoint the cause of the future economic events. Once something happens, the market reacted almost instantly because the market is very efficient and it is too late to jump into the market or get out of the market. It already reacted as it happened.

I believe the only thing that explains accurately and precisely to predict market movement is understanding speculation. To do so, I use Time Principles.

One thought on “Understanding Speculation on 2020-2021”