I am currently very pessimistic about the general market (SP500, Dow, and Nasdaq). Even if a corporation is performing an incredible job in every way better than any other stocks in the same field and its price is discounted, I would still stay away. I am positive that it would probably underperform until a whole market becomes more optimistic. My prediction says that the best time to start investing in stocks is in 2024. I expect that the market price will keep lowing itself and dragging all other potential stocks down to the abyss regardless of their performances.

However, there is always an exception. During this time period, I am only optimistic about oil stocks. My technical analysis indicates that there is more room to be filled and won't be affected by the general market as much and the current economic situation provides me a good confirmation. I wouldn't be hesitant to leave at least until the Russian and Ukrainian War ends, settles, or lessen to some degree.

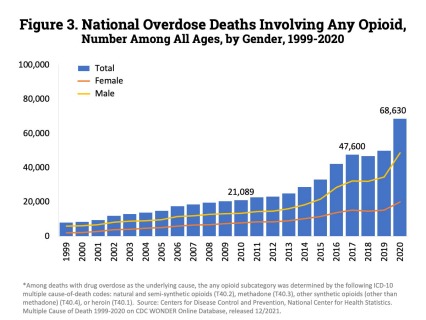

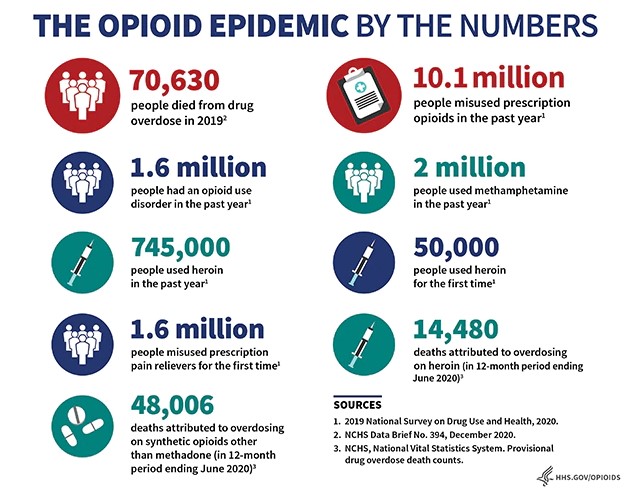

Anyway, I started seeing an interesting stock trend in a certain field, pharmaceutical. Among all the pharmaceutical stocks, a few pharmaceutical companies caught my attention, which are the manufacturers of opioid drugs. I am referring to opioid manufacturers, not distributors. Due to the opioid crisis declared by the Department of Health and Human Services (HHS) and the National Institutes of Health in 2017, many opioid manufacturers started facing litigations over their alleged role in fueling the opioid crisis in the United States. These stocks hit the top in 2015 and gradually lowing their price to the point called discounted price and attracting some value investors. The time was up for the bull for the stocks in 2015, almost 8 years from the top. Correspondingly, the more the death rate has increased due to the overdose of opioids, the lower the stock price became. The death rate has gradually increased to over 42,000, 46,802, and 68,630 in 2016, 2018, and 2020 respectively. Of course, the death rate should be a factor in dropping the stock, however, I believe that that is not a major one. Time is. There is a sign of a bottom around the corner among these stocks.

Remember, this opioid crisis was initially brought to the public attention in 1990 and the overdose death rate has never declined ever since, disproportionally, these stock prices shoot out the roof meanwhile.

According to their charts, I expect them to hit the bottom sooner than any other stocks and the general market will. When the time comes, a tremendous amount of cash would start flowing into the stocks and drive the price back up to the equilibrium price or more. Their market is currently making errors and quoting significantly lower prices. It may keep dropping the current prices further away from the reasonable price and constantly gives you a stomachache, however, it should go away in 2023. They may be facing bankruptcy in the worst-case scenario. However, I believe that the price would recover before it happens. That is when an opportunity lies. The opportunity is Opioid.

One thought on “Opioid Global Crisis and Opportunities”