I do not trade all the time because I am not a day trader. I rather categorize myself as a swing trader and monitor and verify whether a stock moves according to my prediction most of the time. The recent prediction was made on July 27, 2022, Opioid Global Crisis and Opportunities. I have been following some Opioid Crisis stocks and verifying how the price movement behaves over the last couple of months. All the opioid stocks have been severely impacted by the crises since 2015 and accelerated downward rapidly recently by General Market. I do not think anyone sees that as an opportunity in Opioid Stocks. It is a chaotic market and does not seem to get better. I bet that the opioid manufacturing sector gets worse and worse as people realize that our economy is heading to a big bear market. However, I believe that I have an advantage in selecting a great stock by figuring out its sequences and be able to find a sleeping giant which out-performs better than any other stocks in this chaotic environment.

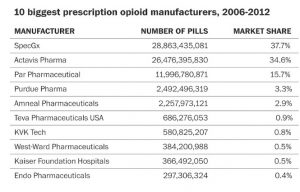

First of all, I listed some well-known opioid manufacturing stocks and started understanding their status, health, and trends in sectors. By looking at the charts, any of the medical opioid-related companies (Medical or retail corps) didn't interest me at all. So I narrowed it down to the opioid manufacturer corps.

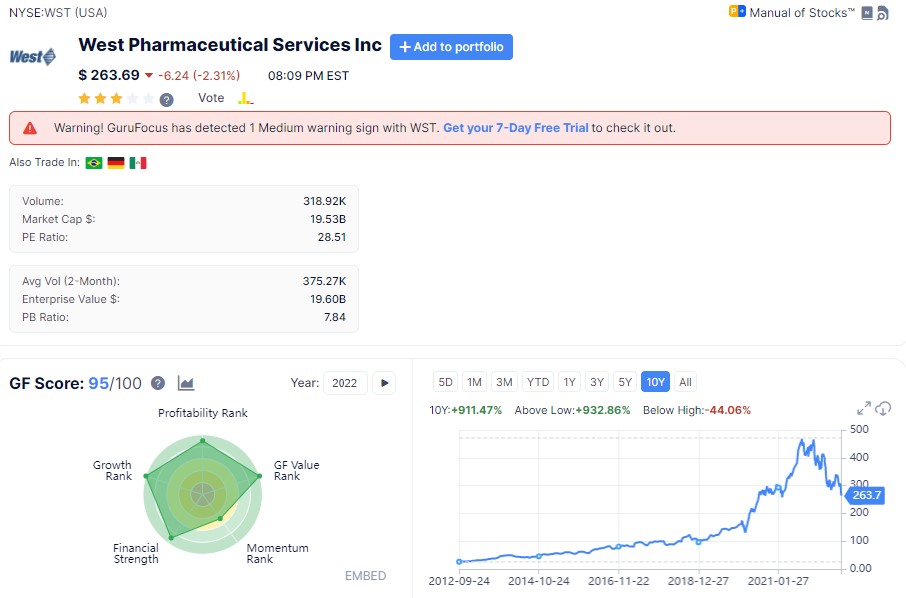

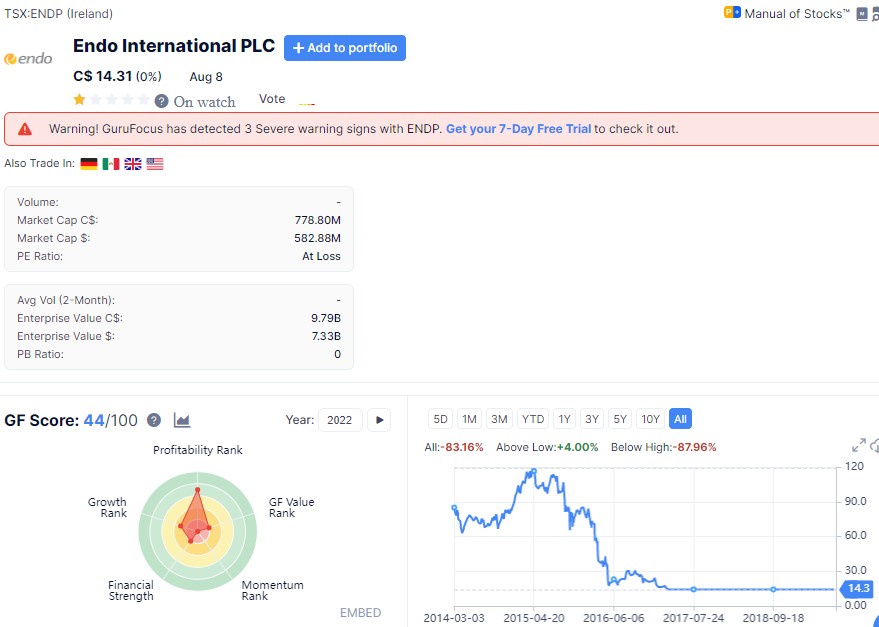

I found out that many Opioid manufacturing companies went bankrupt or become private corps last seven years after being acquired by a big corp. They are not publically traded anymore. Only two stocks out of the list caught my attention. One is WST: West-Ward Pharmaceuticals and the other one is ENDP: Endo Pharmaceuticals. By analyzing the financial foundation of the companies, it was obvious that WST is a superior one. Its revenue has been growing annually and less debt and various numbers show that it is an excellent value stock. On the other hand, ENDP is kind of stagnant and has not shown any growth last 7 years, and carries more than $8 billion in significant debt due to many opioid crisis litigations. On top of that, ENDP filed for Chapter 11 bankruptcy on 8/17/2022.

West-Ward Pharmaceuticals

Endo Pharmaceuticals

The answer seems to be obvious if the options were only two anyone would pick West-Ward Pharmaceutical stock. However, I picked ENDP and bought many shares at $0.10 on 9/15/2022 because I liked the Endo Pharmaceuticals chart sequences and believe that $0.01 is near the bottom. I am not a traditional value investor, however, I still trade value stocks within a certain time period and rules. In this case, ENDP is offering $0.10 and seems to go down to zero. Majority of institutional fund corps and investors walked away before and after the Chapter 11 announcement and show the devastating speculative market as the price went down to $0.10 after the huge sell-off from $0.50.

Now it is 100% speculation. No financial report or no merger/acquiring news for ENDP for a while. What is going to happen is that they will focus on working with creditors to complete Chapter 11, which may take years. Meanwhile, again trading ENDPQ is pure speculation. I would like to have a holding period of 6-8 months at maximum to trade the speculation because there is a chance that the stock could become worthless upon the completion of Chapter 11. Thus, regardless of the price, I would like to close the transaction within 6-8 months.

ENDP Chart screenshot taken in July. Predicted to hit $0.1-0.12 (Target) to Buy.

ENDP Chart screenshot buying at $0.11 in the middle of September.

It is a type of high-risk stock you would like to avoid at any cost, however, to me, it is a great potential stock that could provide me with amazing returns. If I am wrong, risk management should be able to preserve capital, if I am correct, this may provide over 1000% returns. My target price is $1.00. My trading time frame is 6-8 months. GAME ON!