I started accumulating shares of the energy stock, Blue Dolphine Energy Company since Nov. 2021. The result has been astonishingly incredible. When I realized that the stock was way undervalued and getting quoted at $0.26, I started purchasing without hesitation. It was one of those stocks being forgotten and left out of anyone's attention. Not only that, the long-term cycle just ended, and was about to turn around towards a positive direction according to my theory, Time Principles. BDCO prediction made and posted another blog: BDCO Stock Prediction Made October 2021.

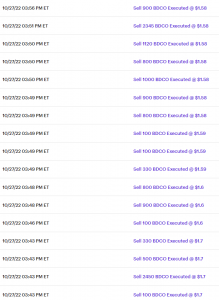

This date, 10/27/2022, I closed some of the shares since the movement of the BDCO stock went exactly what I predicted in day/week scales.

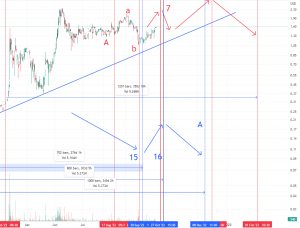

The chart shows some arrows and other Time Principles analysis indicators indicating the future movement of BDCO stock price. The price was predicted to hit the bottom at $1.05 on 9/23/2022 and start making a rally to around $1.85 but not above $1.85. The date price was predicted to the top around 10/27-10/28/2022 and start dropping the price again from next week. As soon as the stock price hit $1.83 at 12:18 PM Pacific time, I verified my theory and started selling BDCO shares. Due to the low liquidity, the market didn't allow me to sell above $1.80 but many shares were sold and executed between $1.55-$1.70.

Some of the transactions executed

Here is a takeaway for a trader who is trading a stock that has low liquidity. You will actively be participating in the market price movements and become a market maker. The disadvantage is that you cannot sell or buy at the exact market-quoted price since the split becomes larger. In this case, even though the market is showing a price of $1.83, you would be forced to sell at $1.70. This cannot be forgotten because it could lead to a significant profit loss if you do not understand how a brokerage operates in a volatile market like this.

Let's say I bought BDCO stock 100,000 shares at $0.26 with a capital of $26,000 and sell at $1.83, total capital you find in your account would be $183,000 and the recognized profit would be $157,000, that is simple calculation. However, if the market is asking you to sell at $1.70 instead of 1.83, the total capital would be $170,000 and the recognized profit would be $144,000. The difference in profit is $11,000. It makes you feel like you are scammed! What a difference that is.

What's it like to be a market maker? Right after I sold the BDCO shares, the price dropped from $1.83 down to $1.53. The reason why I know this was me making the market movement is because of the volume traded in the min scale. This happened 5 mins before the market closed at 12:55 PM Pacific Time.

The next move I am planning to make is to buy back the BDCO stock shares at a lower price since I'm predicting that the BDCO price would drop after 10/28/2022 until either around 11/14 or 12/8/2022.

The blog has been updated to show the result of what price went afterward.