Crude oil boomed in March which was a month after the break out of the Russian and Ukrainian war. Crude oil hit $130, the second-highest price in history. Many people bought oil ETFs and stocks right after, however, the price took a correction. The correction ended in September 2022 and started making a rally again. The rule of thumb is that, if you do not have an edge to work with against the market, you do not ever follow the media. When they say, oil is up, SELL. When they say oil down, BUY. This isn't as easy as it sounds because people who do not know how to react to the market usually end up with losses. Even if you understand how emotional indicators work rationally, it is still difficult to time the market.

I predicted the oil price getting bottomed out and was ready to rally during July (Rallies Predicted On Oil Stocks Between Aug To Dec 2022). The results are astonishingly beautiful.

APA Predicted around $35

APA Result at $50

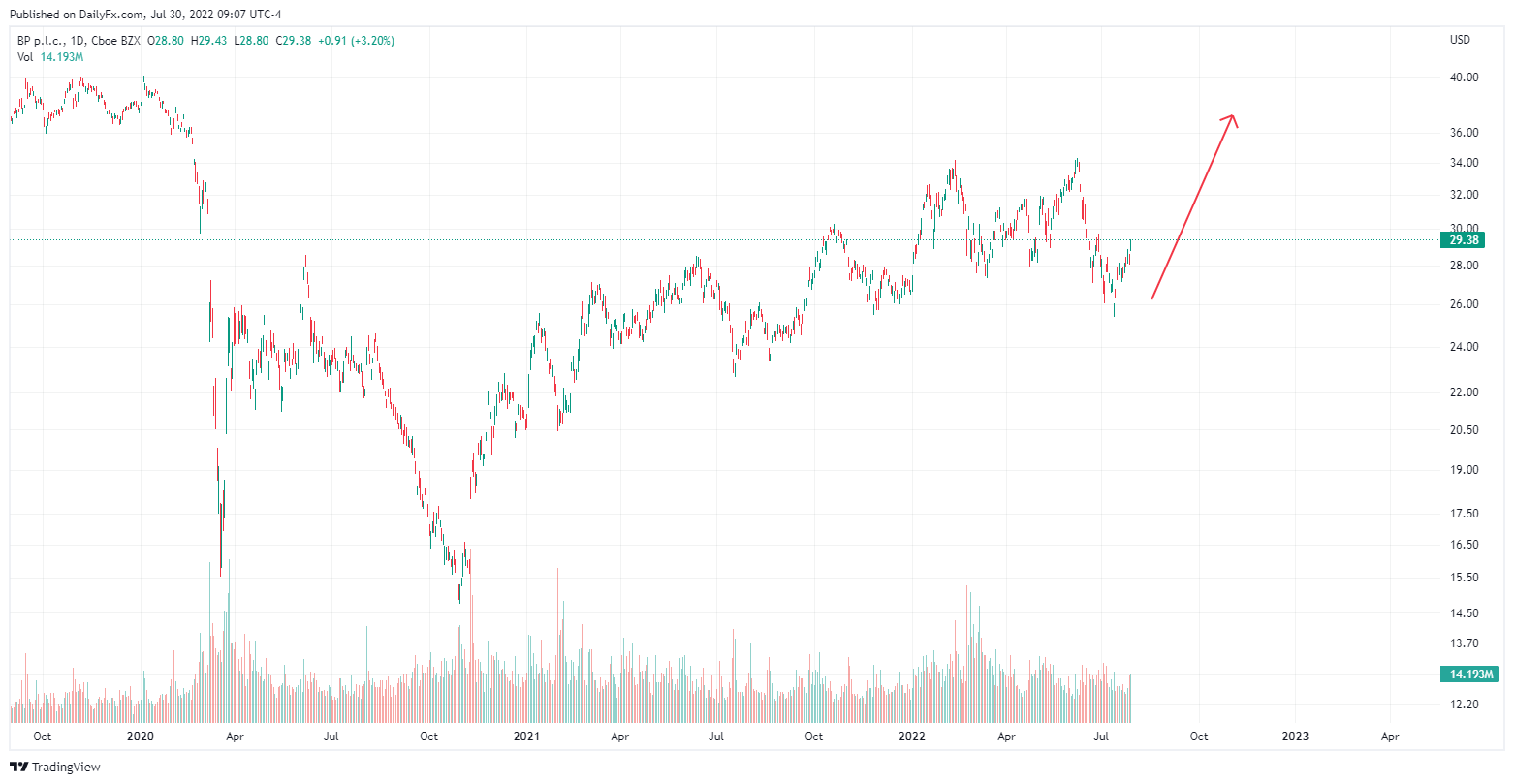

BP Predicted at $27

BP Result at $34

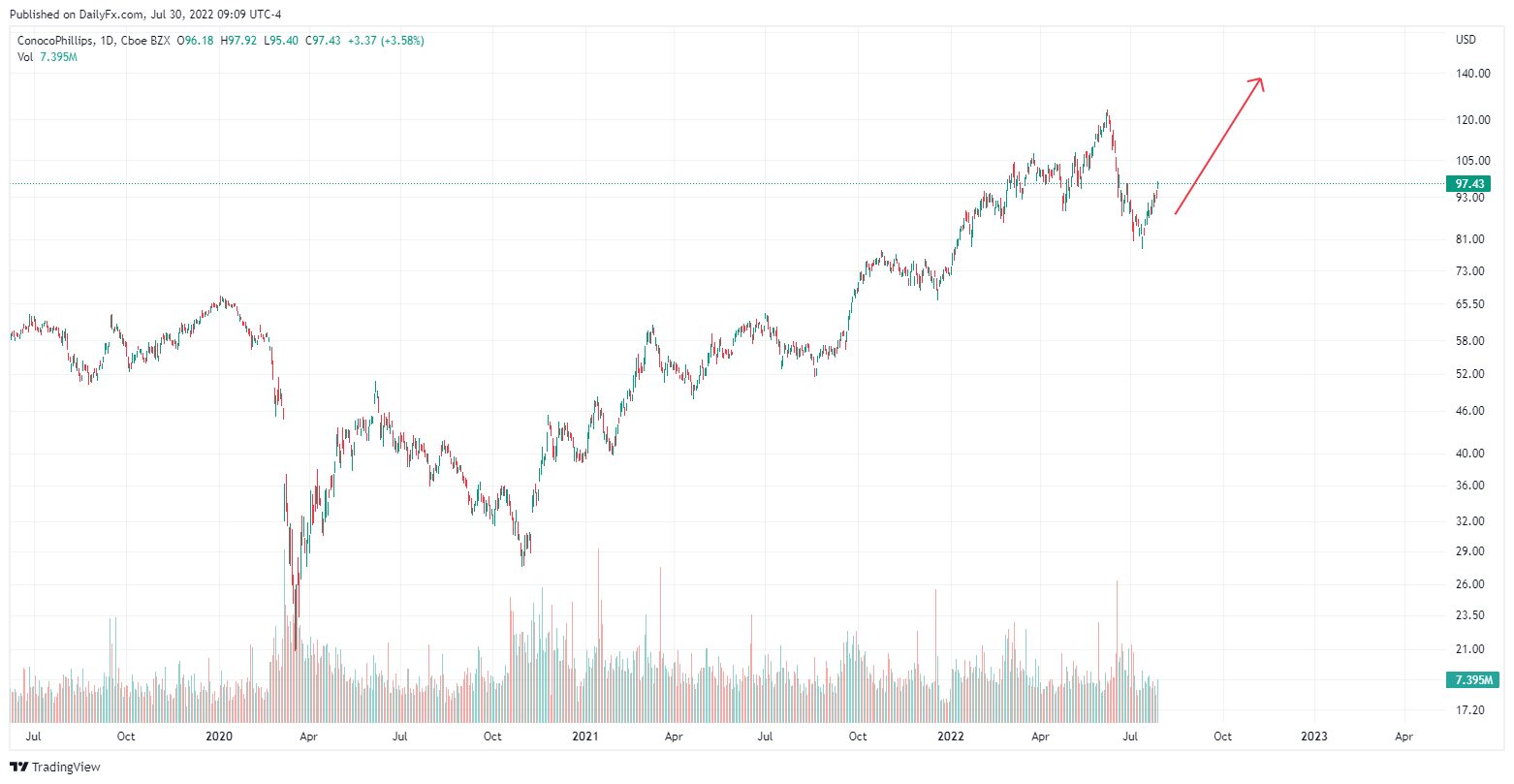

COP Predicted around $85-90

COP Result at $138

XOM Predicted around $90

XOM Result at $112

Crude Oil Future Predicted above $95

Crude Oil Future Result $93

If you chose APA (APA Corporation) at $85, the return would have been 30%.

If you chose BP (BP p.l.c.) at$90, the return would have been 20%.

If you chose COP (ConocoPhillips Company) at $85, the return would have been 39%.

If you chose XOM (ExxonMobil Corporation) at $90, the result would have been 20%.

If you chose Crude Oil Future at 95, the result would have been -1%.

It looks like Crude Oil Future is struggling to price back up to where it was at $130. However, the other stocks have gone up to 20%- 40 % within a couple of months, which is quadruple of the average investor return. In 2022, everyone is losing at least 25% since the long slow recession set in after getting double punches from the economic impact due to COVID-19 and the Russian and Ukrainian War. Now, I believe that the market price for these stocks would decline, thus this may be the best time to get out and recognize the profits. This is how I handle swing tradings. Do not be greedy. Be rational and stay out of the market if you do not know what the market would do with high probability next until you do.