The final blow to the market is now obvious to be seen although it was difficult to be recognized if you were in the middle of the market heat in 2021. One of the final blows of the bubble was caused by the multiple distributions of cash, stimulus checks during the covid-19 lockdown. Once cash was distributed, billions of cash started flowing into the market because people were trying to make money trading at home. These behaviors were observed throughout the nation and brought pure speculation to the market and also euphoria among many professional investors, and amateurs traders.

People who never traded/invested in the past were making hundreds of thousands of dollars with stocks. Crypt Currencies made hundreds of people millionaires in a few years with a little principle. Hundreds of small and micro stocks boomed just like Crypt Currencies (Understanding Speculation on 2020-2021). You would have realized that this was not normal market behavior if you experienced and truly understand how the market works. This was pure speculation that brought us nothing but craziness. Whatever the price quoted for individual stocks, S&P500, NASDAQ, and Dow Jones in 2020 and 2021 were not able to be justified. I know many people, even institutions, and hedge funds lost their rationality and went nuts. They were not even capable to analyze what they were investing in because of the heat and euphoria created by the market.

I am a technical analyst and believe in Elliot's Theory. The final blow was completed with the 7th wave of Elliot's wave. However, it fooled me a big time because I was fairly confident that the bull ended with the 5th wave on 3/21/2020 because Eliott Wave Theory usually finishes with a 5th wave and tops the market. I believed that the lockdown and the pandemic declared by the Public Health Department and WHO (World Health Organization) were good confirmations. Also, 6th wave passed the strong resistant line at the time and was ready to have short positions after making a quick and fast correction before entering bear.

<S&P 500>

However, I was wrong. It took me a little while to realize that it is a correction to make another wave. The final blow was created to fight against many shorters after 3/21/2020. This can be explained well by the quote made by John Templeton.

“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.” --John Templeton

The market had lots of pessimism after 3/21/2020 and was making another wave gradually. The real market crash was followed by euphoria a year later 3/20/2021. Meanwhile, many people enjoyed riding the last wave for a year. BOOM on crypt currencies, GME, AMC, TSLA, APPLE, NVIDIA, AMZN, and small-cap and even OTC stocks. Many stocks including Chinese stocks boomed during 3/20/2020-3/20/2021.

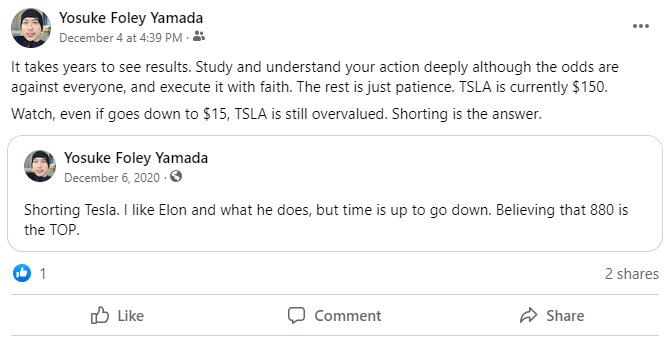

When I realized the market is becoming nuts in Dec 2020, I decided to short TSLA at $880 expecting that it is hitting the near top. It took two years for TSLA investors to finally realize how overvalued it is and started acting accordingly. TSLA split stock on August 25, 2022, a 3-for-1 split ($400 is equivalent to $1,200 pre-split). On this date 12/18/2022, TSLA is $150, which is equivalent to $600. It took me two years of patience and faith to see theresult but it is still the beginning of the bear and I believe that TSLA is still overvalued at $15.