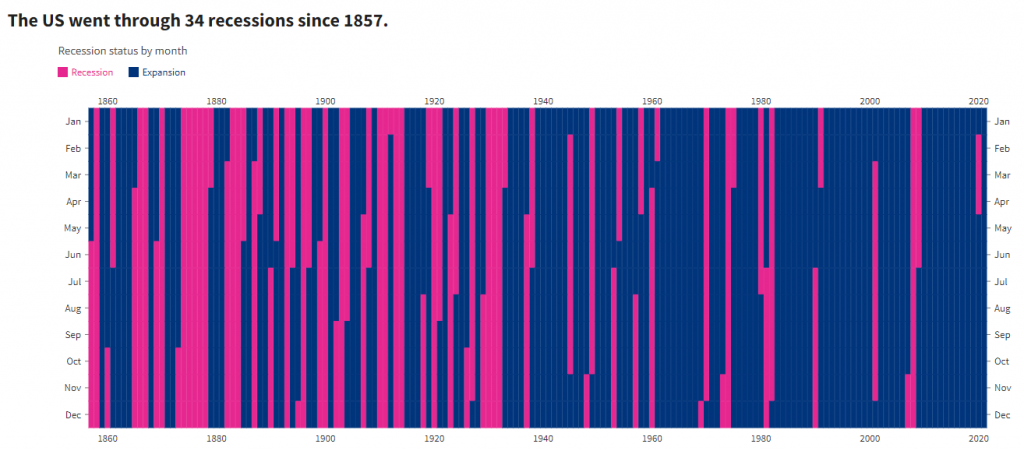

The United State has gone through 34 recessions since 1857.

As you notice, there has been a significant change in the duration and frequency of recessions and expansions. Analyzing the pink area between 1857 to 1935, many random recessions took place, which does not show any pattern of recession occurrences. Recessions sometimes lasted 8-10 years, and sometimes lasted less than a year. Recessions occurred uncontrollably at random. However, if you take look at the occurrences of recession after 1935, the frequencies of recession change dramatically as well as the duration of the recessions. This is not a coincidence. The reason for the change is because of the U.S. Securities and Exchange Commission (SEC). SEC was created aftermath of the wall street crash, also known as the Great Depression in 1929-1932. SEC was created to commit to three-part missions: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation.

One thing I can tell is that they have been doing great jobs. The market has stabilized and maintained its order as it was intended to.

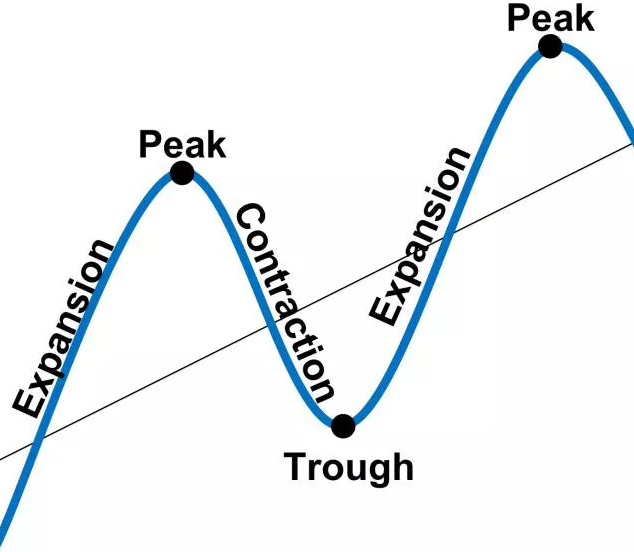

However, regardless of their efforts, the market still has to go through some level of a business expansion & contraction cycle. The periodic availability or scarcity of cash, the movement of interest rates from low to high, and the reaction of businesses and consumers to these conditions all play a role in creating the business cycle. The image below shows what a business cycle is consisted of. There are four stages: Expansion, Peak, Contraction, and Trough.

Expansion (2009 - 2020):

Expansion is the business expansionary phase, which the Feb brings on by lowering interest rates and adding money to the financial system. Banks, in turn, are encouraged to lend out extra money and companies start taking advantage of the availability of loans and low-interest rates to purchase factories and equipment and also hire employees to produce more products and services. This phenomenon helps to grow customers and the economy eventually.

Peak(2021):

As businesses and consumers continue to borrow and spend, their activities put more money into the system. The money supply grows throughout the expansion phase. Consequently, too much money remains in the market and results in a declining value of the money.

In 2020 (at the maturity of expansion), we faced a Public Health Global Emergency, Covid-19 Pandemic. The Fed did not have any choice but to provide stimulus checks multiple times throughout the nation during 2020-2021 and flooded money in the market. As result, prices of products and services rose and caused massive inflation. The highest Inflation was recorded at 9.1% in June 2022. Due to the super high inflation, the Fed had to remove money gradually from the system by issuing Treasury bonds and by raising interest rates since the beginning of 2022. Investors reacted to the monetary policy quickly and started taking their money out of the market and banks to buy high-interest-rate bonds. In general, investors like to be more aggressive to make money with stocks, not bonds.

This explains that investors are becoming more conservative and thinking about protecting their money. Consequently, Banks start losing money and become hesitant to lend money like during an expansion phase. Bank's response to the economic phenomenon was seen by increasing interest on loans. This was observed very clearly by the sudden increase in mortgage rates and the recent high mortgage rate recorded at 7.08% in Nov.2022 Eventually, the cost of borrowing becomes too expensive for businesses and consumers, and the economy begins to contract.

Contraction (2022-):

Contraction is also known as "recession" and represents the shrinkage of the money supply as companies and consumer curtail borrowing and spending money. Unemployment increases and production decreases. Of course, the consumer has no choice but to tighten their money spending.

The unemployment rate has been still steady in 2022, however, some economical indicators started showing the beginning of the recession after the 3rd quarter, especially in housing and retail sales and CPI. We are at the tipping point and contraction is predicted to last for a few years.

Trough:

Economic contraction will end as the Fed lowers interest rates and increases the money supply. In turn, companies become optimistic and start funding their business to improve their operations and hire employees. This allows consumers to spend more money to purchase houses and cars at low-interest rates. This phenomenon fuels the economy into the expansion phase of the business cycle again.

The lesson here is we need to identify the phase of the business cycle to change our investment style accordingly. Many of my friends blindly started investing in the expansion phase in 2020/2021 expecting to make money like many others who made money with a recent bubble in Crypt Currencies, stocks, and some commodities. There was an unreasonable level of optimism, excitement, and euphoria in the U.S. economy although the market was just accelerating to end the expansion phase. They are still struggling to make their money back and looking for stocks to buy. Do not buy anymore. Shorting is the answer.