The most admirable trader, W.D. Gann established the Law Of Vibration in the early 1900' and his books helped me to understand how the market works, by far the best, better than anyone else alive in this era. His philosophy taught me which direction to look in the crazy and fast-changing environment and what fundamental factors to be considered, which lie behind the market to drive stock and commodity prices to move up and down. His theory is not yet fully understood even after decades of study and I see that many institutions and investors/traders regard his methodology as "technical", however, I have to say "this is wrong", I rather want to regard it as "fundamental".

His understanding of the market is still unknown. The perspective of his philosophy cannot be understood in the way of generally accepted study. Understanding of his theory requires the deep study of many subjects, not only economics, finance, and accounting but also mathematics, physics, psychology, astrology, etc. without having academic boundaries.

The quote made by W.D. Gann

'The most money is made when fast moves and extreme fluctuations occur at the end of major cycles."

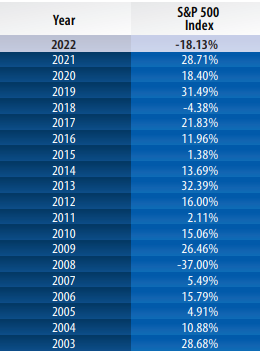

The last 20 years of S&P 500 performance which represents the U.S. economy proved that Gann's quote was very accurate and still applicable to the modern market. The U.S. market turned around in 2022 and currently making a bear trend. However, a tremendous amount of capital was accumulated at a fast pace and at the end of the long bull in 2021. The annual rate was recorded at 28.71% which is the second-highest return since 2003. The bull started after the completion of the bear trend in February 2009 and lasted for 13 years. A significant amount of cash being tossed into the market due to the multiple stimulus checks and the remote working environment due to the covid 19 lockdowns, encouraged people to access the market to drive the market price to shoot off the roof as if the market was pushing itself hurridly upward to burst the U.S. economy.