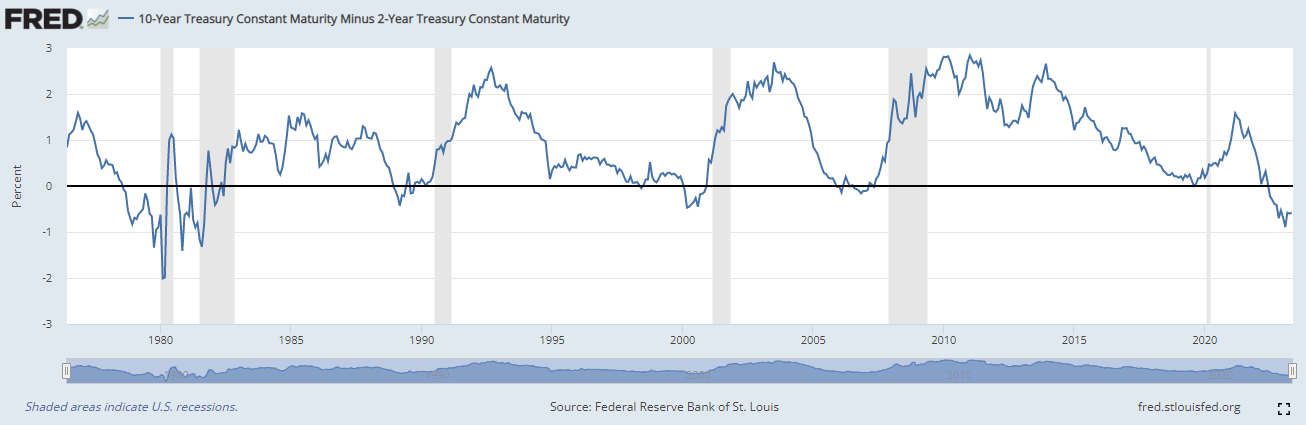

One of the well-used recension detection leading indicators is the 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity. In the past, the indicator has been indicating when the next recission takes place very accurately beforehand. This can be seen in the chart below.

<The 10-2 Treasury Yield Spread is the difference between the 10 year treasury rate and the 2 year treasury rate. A 10-2 treasury spread that approaches 0 signifies a "flattening" yield curve. A negative 10-2 yield spread has historically been viewed as a precursor to a recessionary period. A negative 10-2 spread has predicted every recession from 1955 to 2018, but has occurred 6-24 months before the recession occurring, and is thus seen as a far-leading indicator. The 10-2 spread reached a high of 2.91% in 2011, and went as low as -2.41% in 1980.>

As you can see, where we stand on 5/21/2023 is around -0.8-0.9 Percent which is below 0 percent and proven to be the turning point, and then start having recessions lasting 6-24 months in the past. The highlighted gray area is the recessions. We do not know exactly when and how long the next recession would last since each recession is different. However, we can predict roughly when a recession is going to happen by understanding the trend of the 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity and where the U.S. economy stands (housing starts, employment/unemployment, CPI and etc). According to the chart, we are currently far below 0 percent and expect to accelerate downward in the near future. Any negative economic event can trigger and put us into a recession. Over the course of five days in March 2023, three small- to mid-size U.S. banks failed, triggering a deep and sharp decline in global bank stock prices. This 2023 banking crisis is expected to last and keep jeopardizing many other banks as interest rise and maintains high.

"Many banks within the United States had invested their reserves in U.S. Treasury securities, which had been paying low-interest rates for several years. As the Federal Reserve began raising interest rates in 2022 in response to the 2021–2023 inflation surge, bond prices declined, decreasing the market value of bank capital reserves, causing some banks to incur unrealized losses; to maintain liquidity, Silicon Valley Bank sold its bonds to realize steep losses" Wikipedia