Trading/investment is a business just like any other business. Many successful business owners whatever they do, learn skills, and knowledge, and earn experience in their profession over a long period to become confident, and then they start running their own business. They always measure and track a record of their performance.

They understand the risks of their business and plan and calculate to make constant money to be profitable before putting their saving onto a new journey as a business owner. It is not about just spontaneous acts with hope, it is about planning and risk management.

However, when it comes to trading/investment, due to the sophisticated technology, today anyone can access the money market with a computer or a smartphone and start trading and investing immediately. People create an account, deposit their money into it, and start trading in a few minutes. How many people study and research a company, and calculate risks before they purchase stocks and maintain their performance record ..5%? Probably less than that. That is the reason why most people lose their money playing against Mr. Market. You Always Track Your Record.

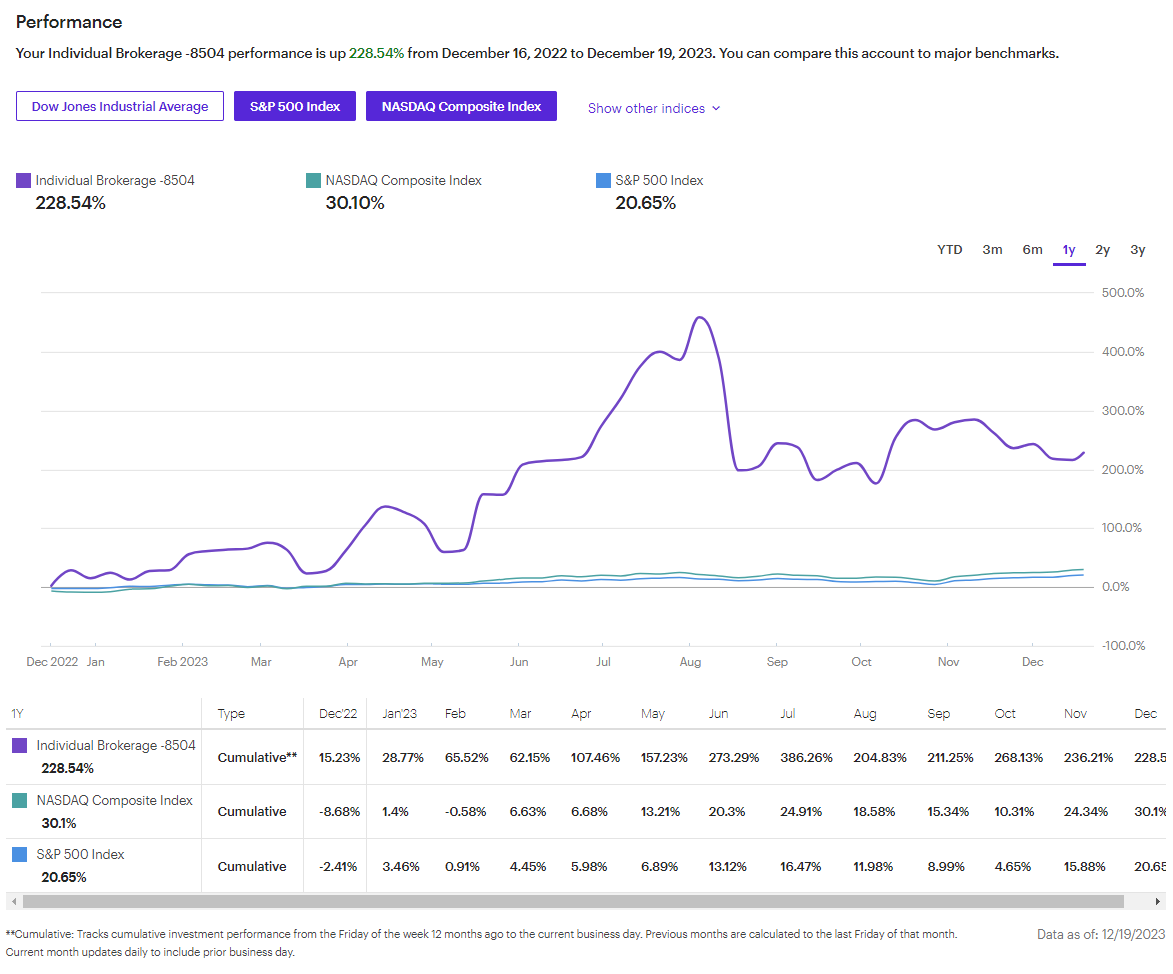

<My Trading Performance in 2023> 228,54%

S&P500: 20.65%, NASDAQ: 30,10%

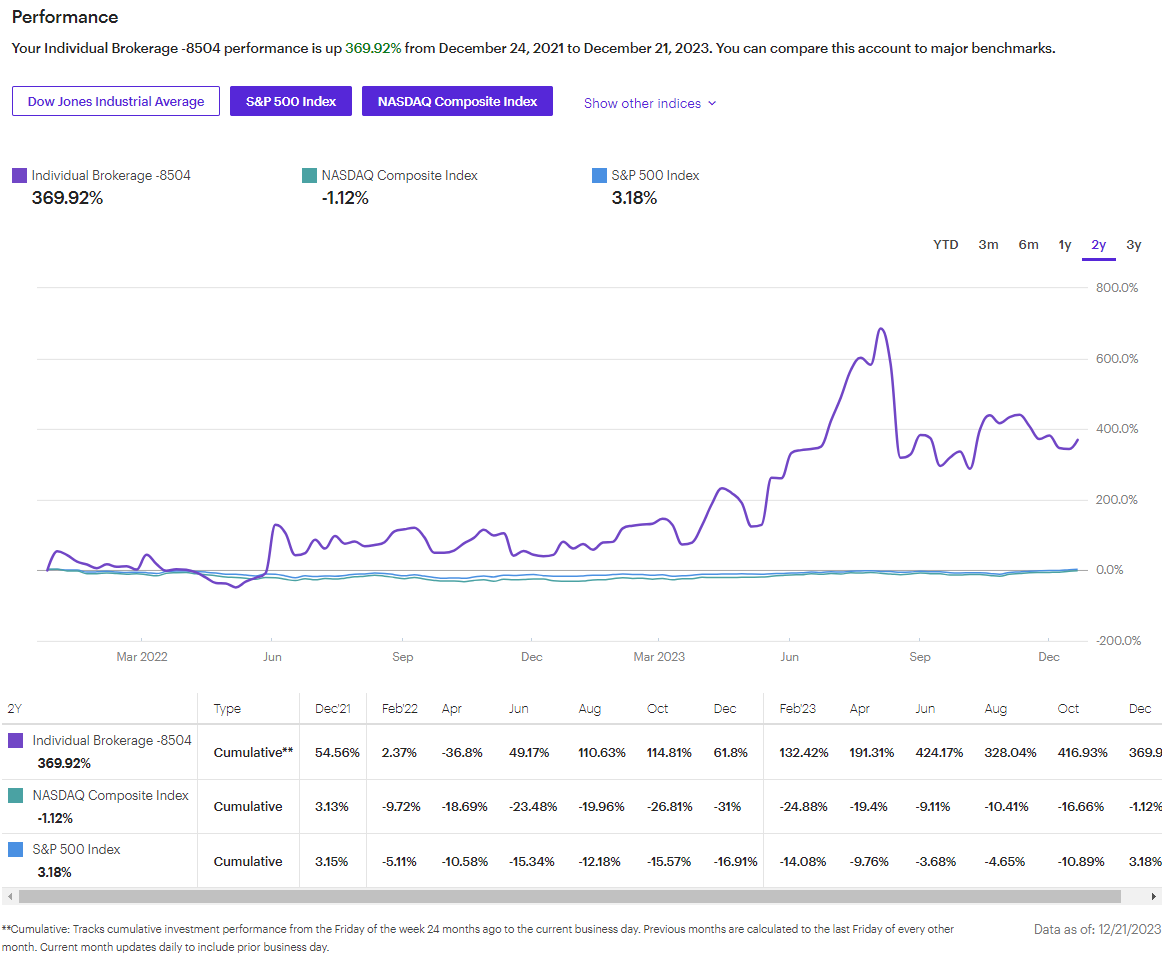

<My Trading Performance in 2022 & 2023> 370%

S&P500: 3.18%, NASDAQ: -1.12%

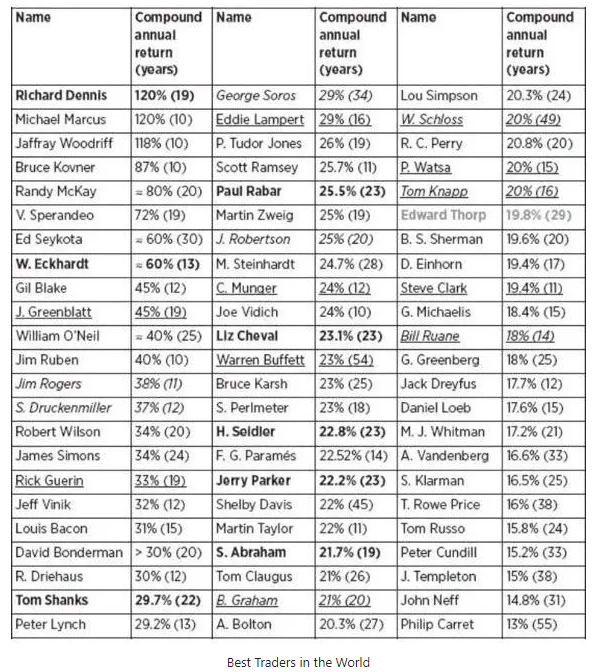

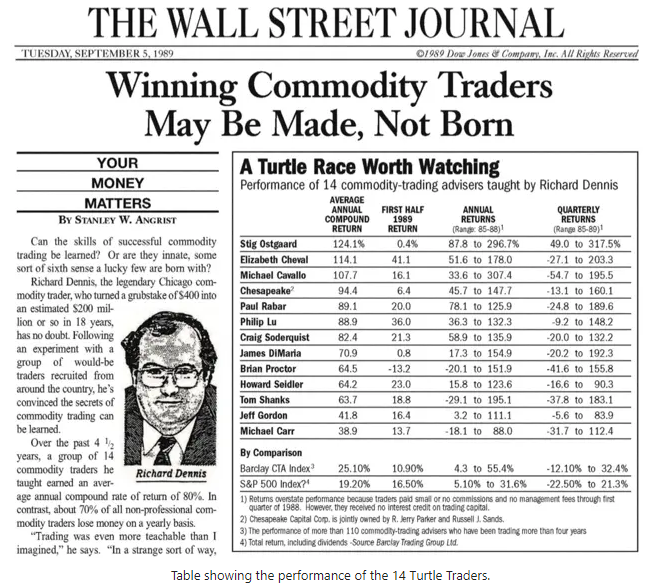

Now let's compare with the annual return of Guru Traders in the World. This is the record published here, Trading performance of the best traders (2022). According to the data, the best-recorded performance in 2022 was Richard Dennis with 120%, the famous trader J. Greenblatt recorded 45%, and even George Soros was around 29%. All guru traders shown here performed better than the S&P 500, which is -18.1%. 2022 was a terrible year for traders and investors, however, they made a phenomenon return.

This article can be used as a reference to display how difficult it was to make over 100% annual return in Wall Street in 1980 and even before that.

My performance in 2022 and 2023 has been more than phenomenal return beating the best of all the Guru traders. Of course, to be called a " Great Trader", I need to maintain the annual return over a sustainable period to be trusted, perhaps longer than decades to prove that I know what I am doing. To show that my exceptional return was not just mere luck, my precise predictions were made since Nov. 2021, and have been tracking the records in blogs to the public. I honestly do not know if I could keep this up, probably not. I can tell with certainty that the more capital increases, the more difficult to keep the mark due to some reasons like slippage, volatility, and influence on market price. However, I am confident that, if I follow my theory, Time Principles, I should be able to beat the S&P 500 and many of the Guru Traders.