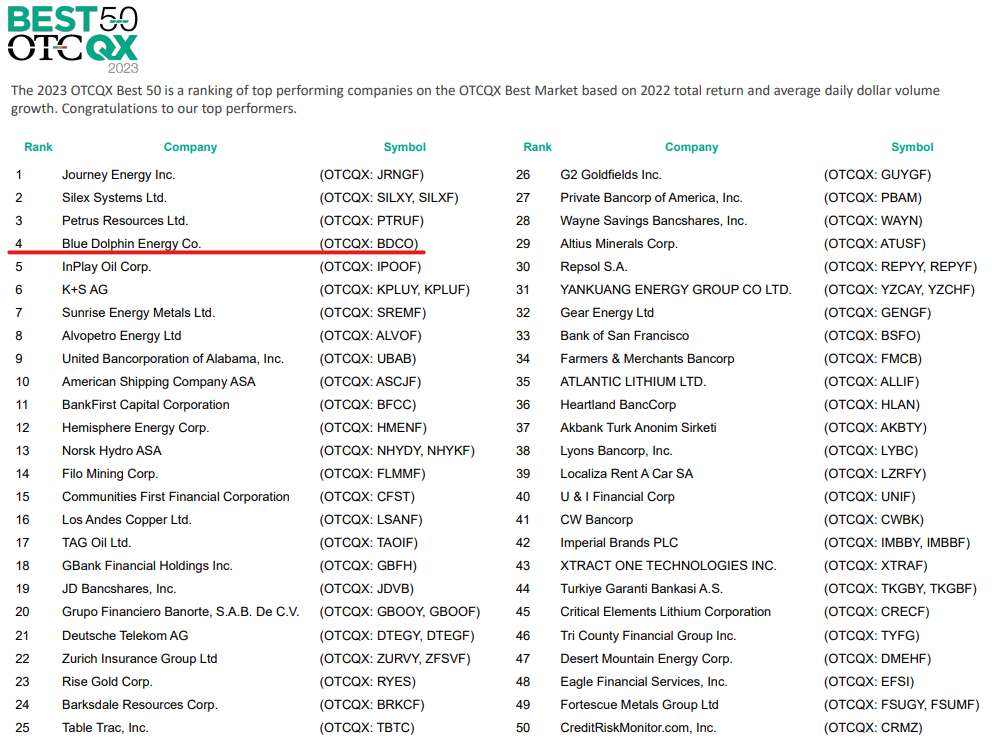

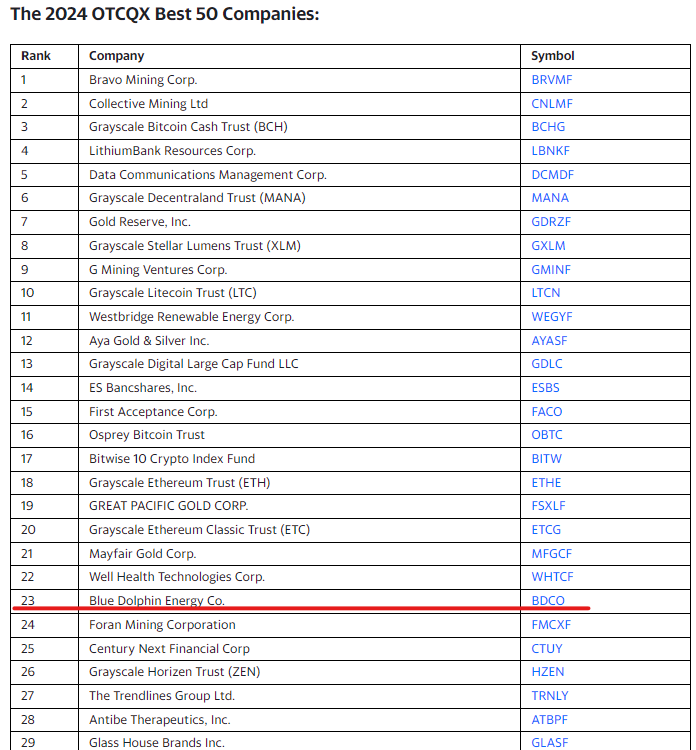

One of the stocks I accumulated in late 2021 and performed better than any other stocks right after the Russian and Ukrainian War was BDCO (Blue Delphine Energy Company). Based on the stock performance in 2022, BDCO was nominated in the 2023 OTCQX Best 50 and ranked 4th place. As expected, the stock price jumped significantly enough to catch any trader's attention almost 10-fold from around $0.25 to $2.38. Today Jan. 18 2024 OTC Markets Group Inc. announced 2024 OTCQX Best 50. BDCO was again nominated in the honorable best performance stock list and ranked 23rd based on its performance in 2023. The highest price recorded was $8.83 in July and rallied over 400%.

BEST 30 OTC QX 2023

BEST 30 OTC QX 2024

The splendid performance results were recorded for Blue Dolphin Energy Company in 2022 and 2023. If you look at the average performance of stocks registered in various exchange markets, in general, the S&P 500 wins almost always. Even if the S&P500 didn't perform well in a year or two, it still beats other markets over a long period with an annual performance of around 12%. The long history of investment proves that OTC, Nasdaq, NYSE, and any other market cannot beat S$P 500 since the high-quality companies registered in the S&P 500 almost always produce great results. This is the index Warren Buffet recommends and holds on to to get a satisfactory result in the long run.

However, my strategy is completely different. I believe that I could beat the S&P 500 by using a simple strategy, finding a stock in OTC that is about to rally and hold on to it for a year and sell with a long-term gain for tax reduction. Repetition of that could bring me extraordinary results potentially 200 %, 300% may be more by picking the right stock at the right time. They say that no one can predict a stock which is about to bottom/top out or about to make a rally because no one can time stocks accurately...

"What if I could". If it is true, It would definitely deliver an amazing result that is not even comparable to the S&P 500 and any other trader's performance. I may not be able to find such a stock always but finding one a year or two years still outperforms very well. Truthfully, many OTC stocks rally more often than any other stocks in the major indexes due to the OTC market characteristics, however, getting out of the market before a bear takes place is a skillful task. People usually avoid OTC stocks because of their low liquidity, high risk, and high volatility problems. Certainly, these are problematic and difficult to trade sometimes, however, my predictions have been very accurate so far since three years ago.

Approximately 12,000 stocks are being traded under the OTC, 6705 stocks are registered under Pink Current, 2,385 stocks are listed on NYSE, 3,908 stocks are listed on Nasdaq, and many other stocks are also listed on other stock exchange markets. BDCO was selected at $0.26 in October in 2021 and picked out of thousands of stocks based on my theory " Time Principles".

<Previous BDCO blogs>

BDCO Sold Tremendous Return From $0.26-$8.00