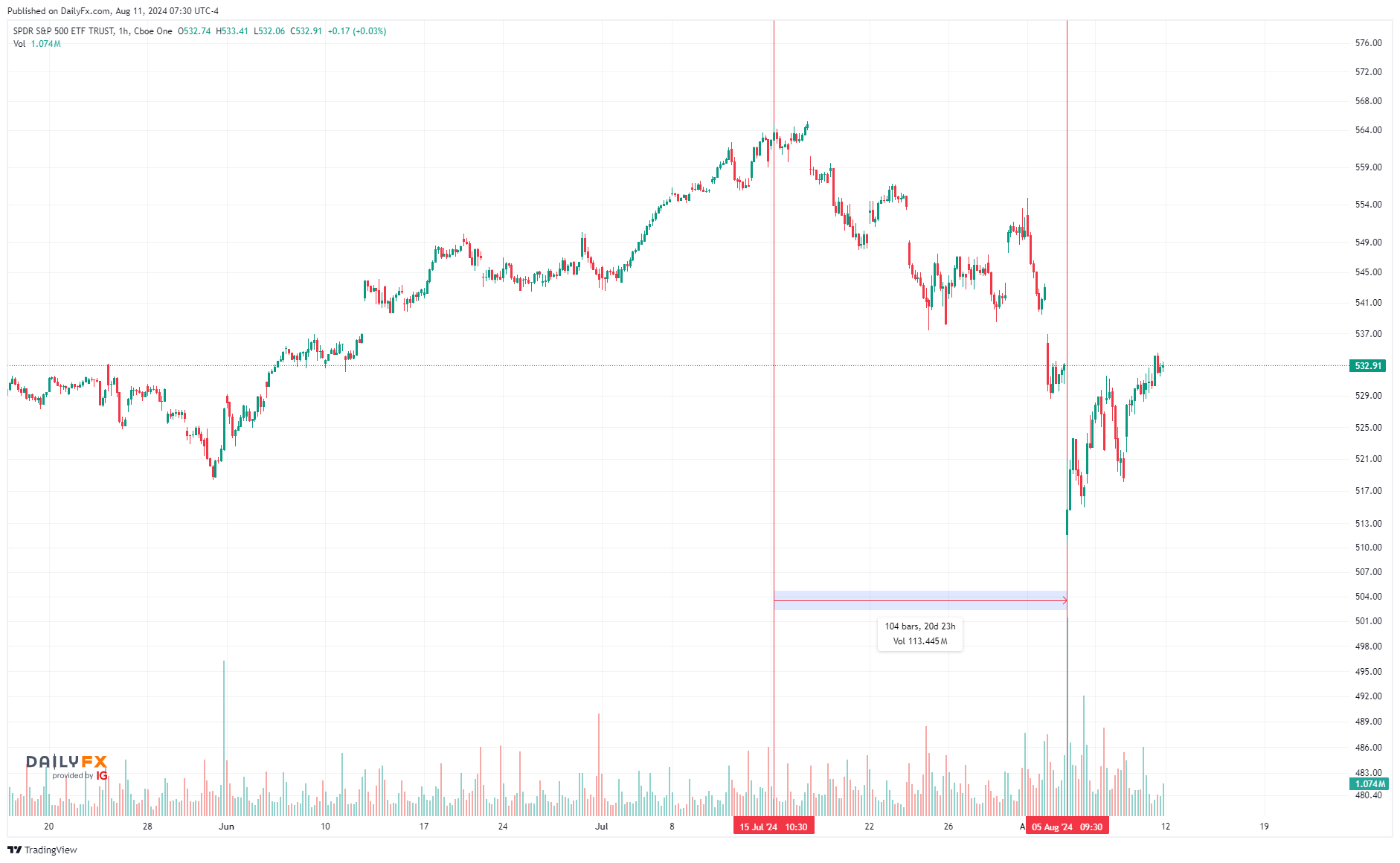

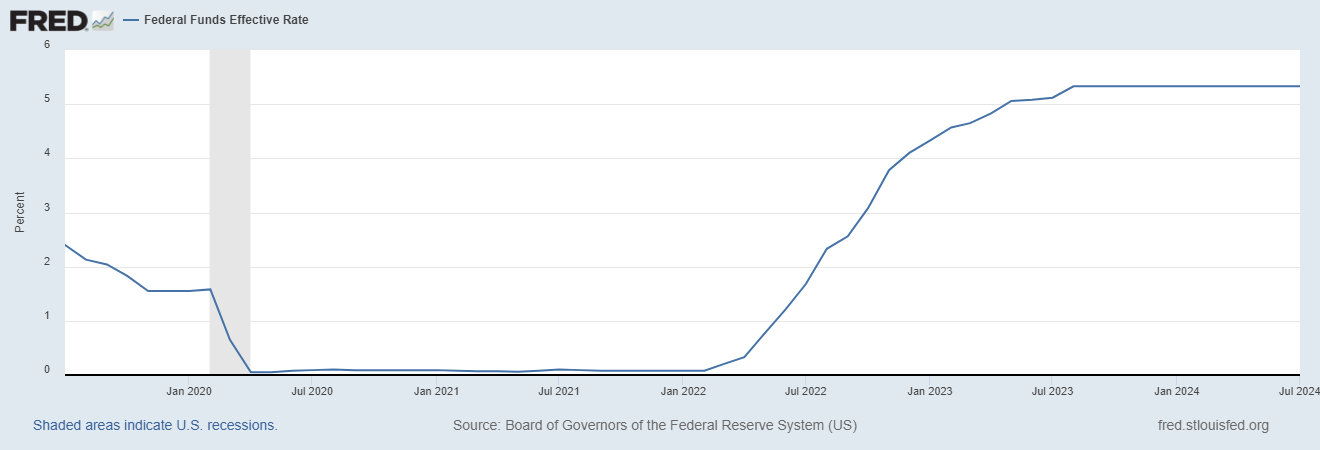

As of August 8, 2024 the Federal Reserve's interest rate is 5.33 %. The Federal Open Market Committee (FOMC) set the rate at 5.25%–5.50% in July 2024 and kept it unchanged from the previous rate increase on July 26, 2023. However, the U.S. market (S&P 500) plummeted and lost trillions of dollars since the 2nd week of July from $5650 down to $5100 in three weeks. Some investors may think that the market would continue making rallies until the next FOMC meeting when the actual cutting of the interest rate occurs. That is wrong. The market does react nonetheless because interest rates still go down. Let me show what I mean.

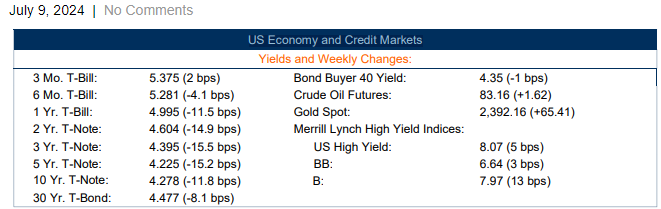

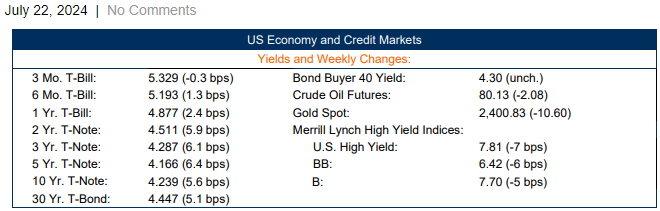

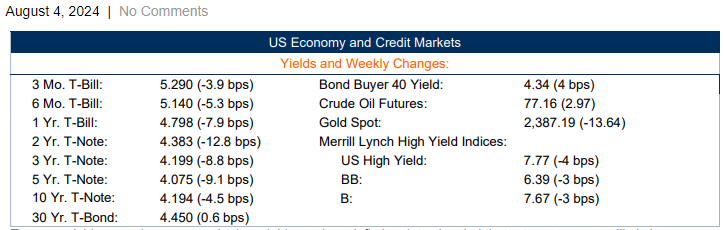

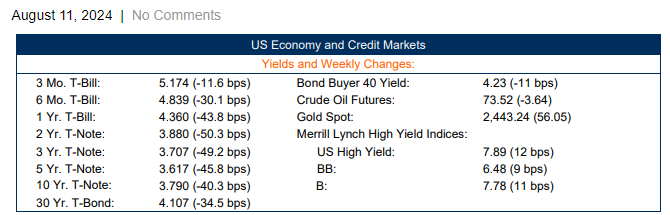

As you see the Fed interest didn't make any move and still remains at 5.3 %. However, the interesting phenomenon of interest rates (T-Bills, T-Notes, and T-Bond) reacted differently as shown below. All these interest rates started dropping after the second week of July.

That means Interest rates can go down without direct intervention from the Federal Reserve, however, the Fed often plays a significant role in influencing them. What are the factors that affect on these interest rates then and cause the U.S. market to start plummeting:

1. Market Forces:

Supply and demand dynamics in the financial markets can cause interest rates to decrease. For example, if there’s a high demand for bonds, prices for these bonds increase, which inversely causes yields (interest rates) to fall.

2. Economic Conditions:

In a slowing economy or during a recession, investors might seek safer investments like government bonds, driving up prices and lowering yields. Additionally, weaker economic conditions often lead to lower inflation expectations, which can also drive down interest rates.

3. Global Economic Influences:

Interest rates in other countries can impact U.S. rates. If other major economies lower their rates, capital might flow into U.S. bonds, pushing rates down. Additionally, global economic downturns can create similar conditions as domestic economic slowdowns, leading to lower rates.

4. Bank Lending Behavior:

If banks perceive higher risks in the economy, they might lower the rates they offer to attract borrowers or reduce lending activity, impacting overall interest rates.

While the Federal Reserve’s policies, such as setting the federal funds rate, have a significant impact on interest rates, these other factors can cause interest rates to move independently of direct Fed action. Thus, you cannot simply assume the market direction because the market may go down without the intervention of the Fed. Investors need to be aware of what influences the market and keep an eye on economics at all times.