The Benner Cycle is a theory developed by Samuel Benner in the late 19th century that predicts cycles of economic activity, specifically in commodity prices and financial markets. Benner was a farmer who turned to analyzing economic patterns after experiencing the effects of economic booms and busts in agriculture. His theory is based on the observation that economic activities follow certain predictable cycles.

Key Concepts of the Benner Cycle:

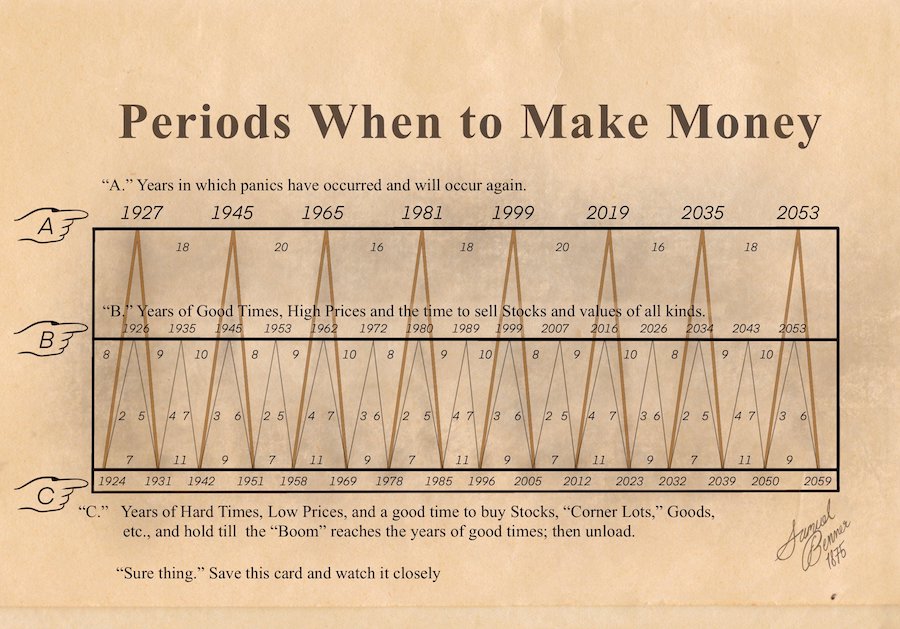

1. 18-Year Cycle: Benner identified a recurring 18-year cycle that he believed could predict the timing of financial market peaks and troughs. According to his research, the cycle consists of 8 to 9 years of increasing prices, followed by 8 to 9 years of decreasing prices.

2. Prediction of Highs and Lows: Benner’s cycle predicts not only the general direction of the market (up or down) but also the specific years when significant highs or lows in the market should occur. He created a chart that indicated “years of panic” and “years of good times” based on his analysis.

3. Market Highs and Lows: Benner’s theory posits that economic and commodity market highs tend to occur at certain intervals, with downturns following shortly thereafter. For example, he predicted that commodity prices would peak every 11 years, and that there would be an economic panic roughly every 27 years.

Application to Modern Markets:

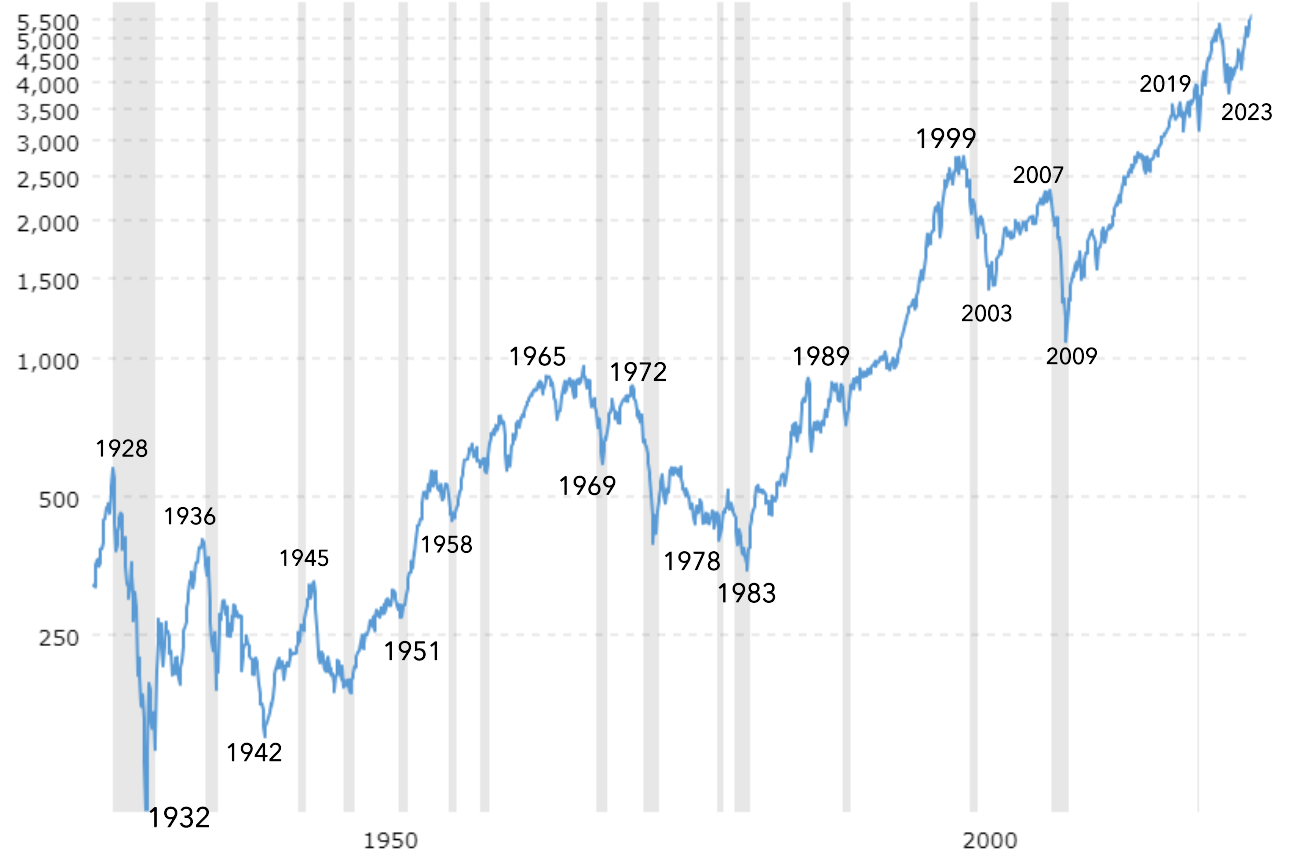

• While the Benner Cycle was initially applied to commodity prices, some modern analysts attempt to apply his principles to stock markets. They believe that the same cyclical patterns can be found in equity markets and can be used to predict periods of bull and bear markets.

• Critics argue that the Benner Cycle is overly simplistic and that while some of the predictions may align with historical events, they do not necessarily account for the complexities of modern economies, such as technological advances, globalization, or changes in monetary policy.

Example:

Benner’s cycle predicted economic downturns (or market panics) in specific years, such as 1873, 1907, and 1929. Interestingly, these years correspond to well-known financial crises, which has kept interest in his theory alive.

Limitations:

• Historical Context: Benner’s predictions were based on the economic conditions and data available in the 19th century. Applying his theory to modern markets requires adjustments and interpretations that may not always hold true.

• Deterministic Approach: The Benner Cycle assumes that markets are driven by cyclical forces that are relatively consistent over time. However, many economists argue that markets are influenced by a complex array of factors, including political decisions, technological changes, and global events, which may not follow simple cyclical patterns.

In summary,

while the Benner Cycle provides an interesting historical perspective on market predictions and cycles, its application to modern markets should be approached with caution. Some investors and analysts may use it as one of many tools in their market analysis, but it is not widely accepted as a definitive predictor of market movements.