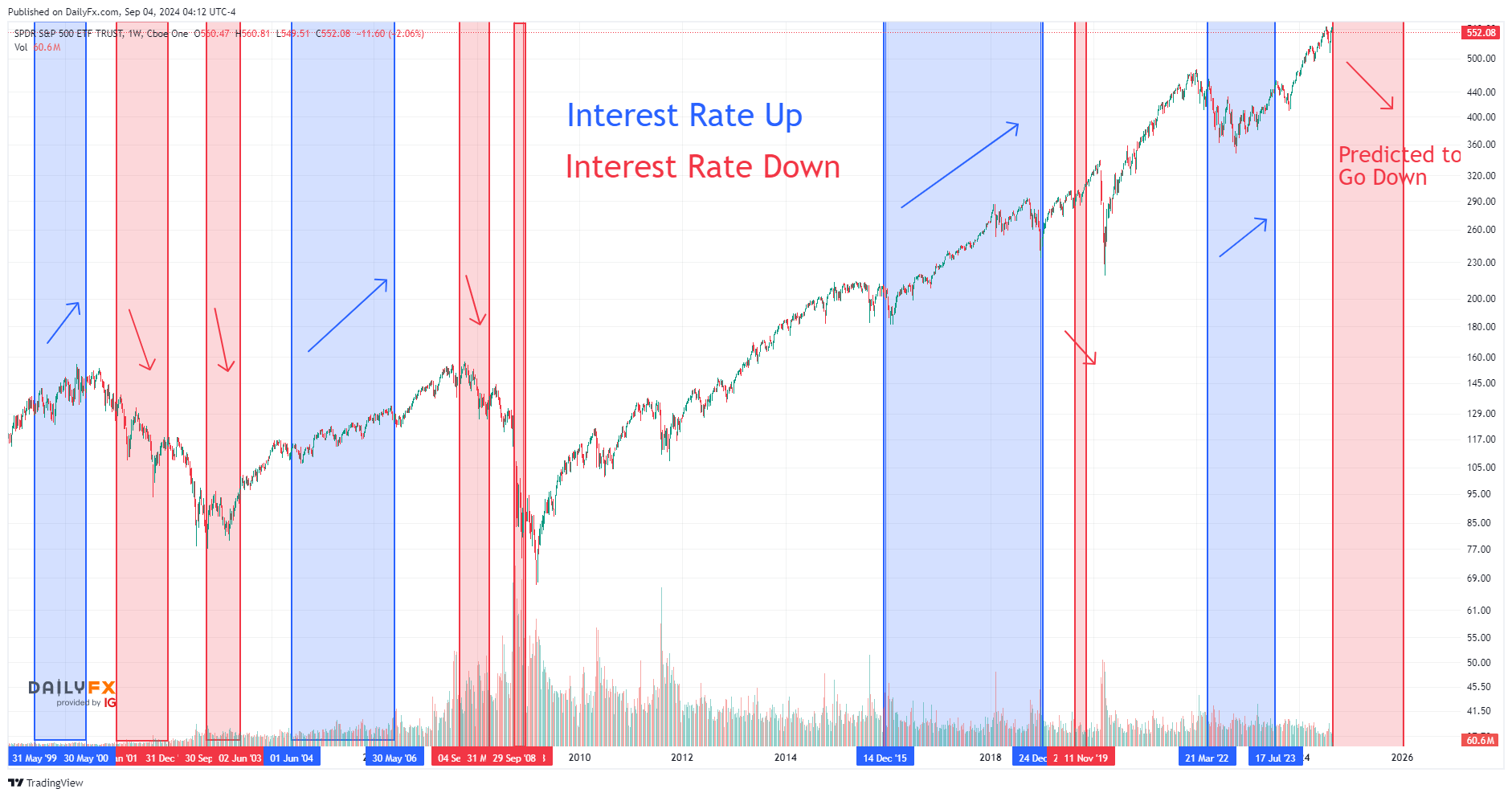

Almost always a recession (grey area) occurs and the market plunges when the Fed begins cutting interest rates historically. However, the mechanism of that is intended to boost the economy.

As a result of cutting interest rates, the mortgage rate goes lower and businesses can borrow more money at cheaper rates, and accelerate the economy further.

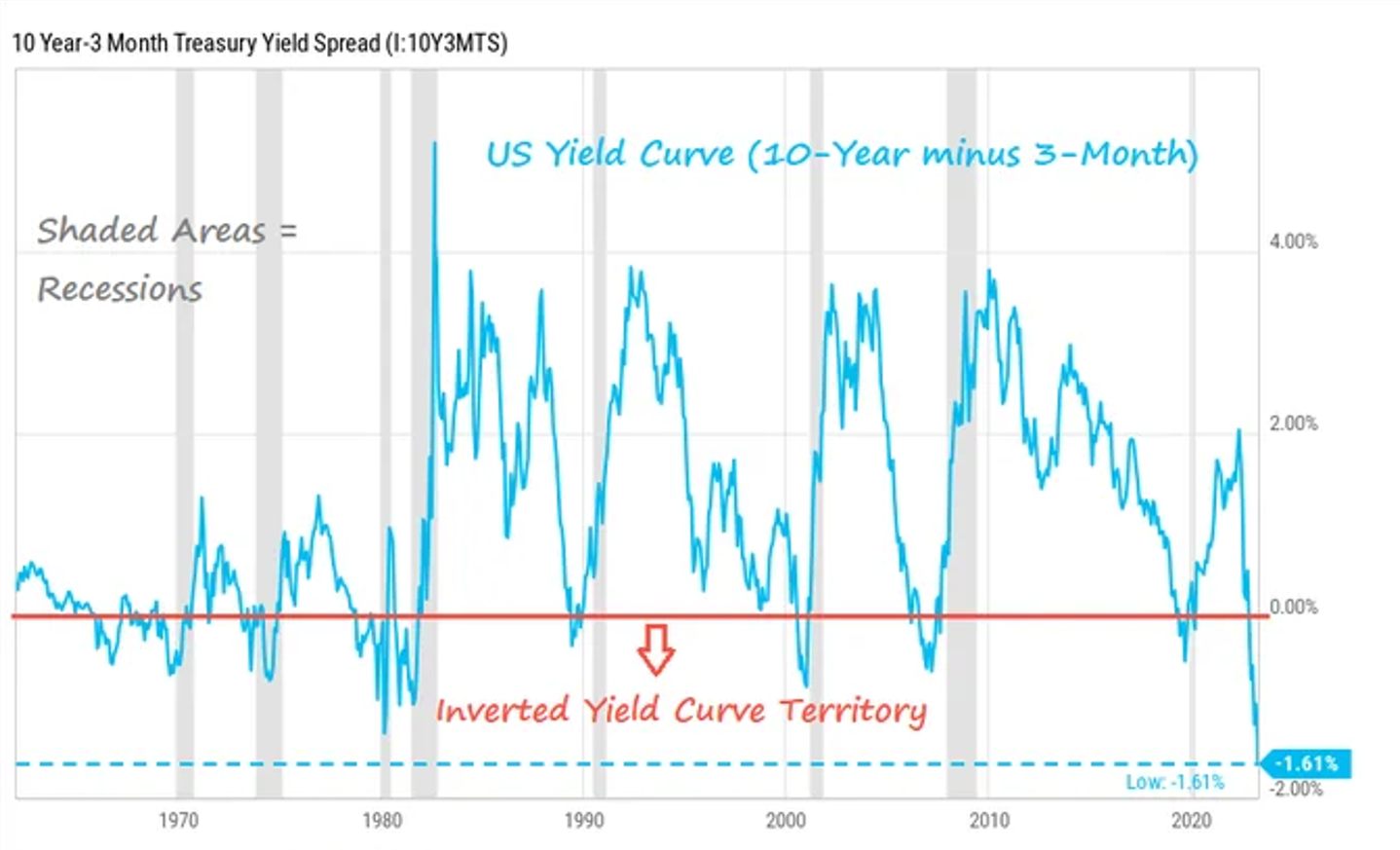

The best indicator of recession, the US 10-year-3-month yield spread (image 3) shows that we are at the bottom and about to rise. As it increases, a recession follows almost always as shown in the grey area. Fed will begin cutting interest rates from this month and expected to continue over the next couple of years.

One of the reasons why Warren Burrett just sold half of Apple stock a few days ago and sitting on so much cash now is to buy more stock when it plunges. Taking advantage of a market correction to buy cheap and increase profit, and that is something you can do.

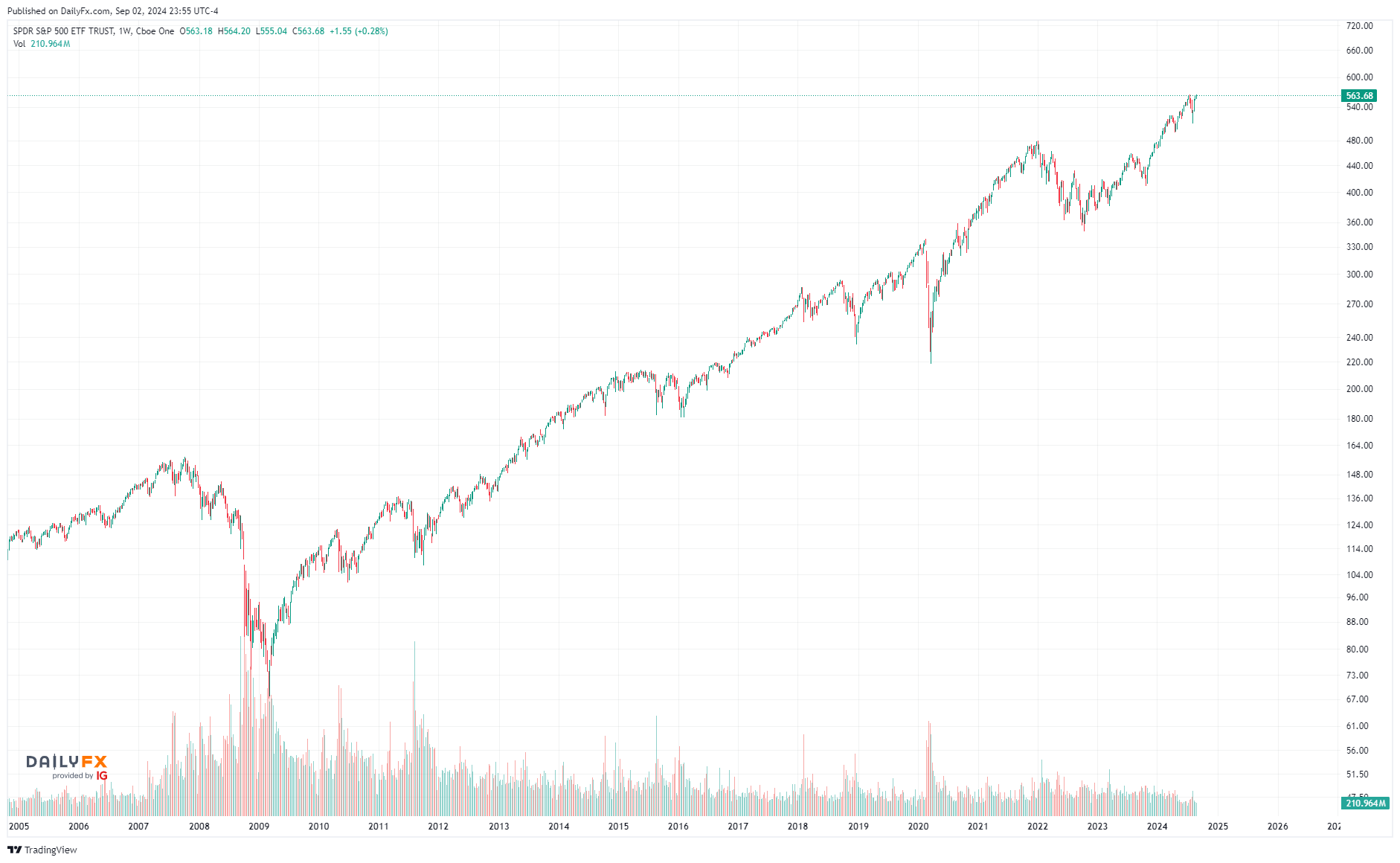

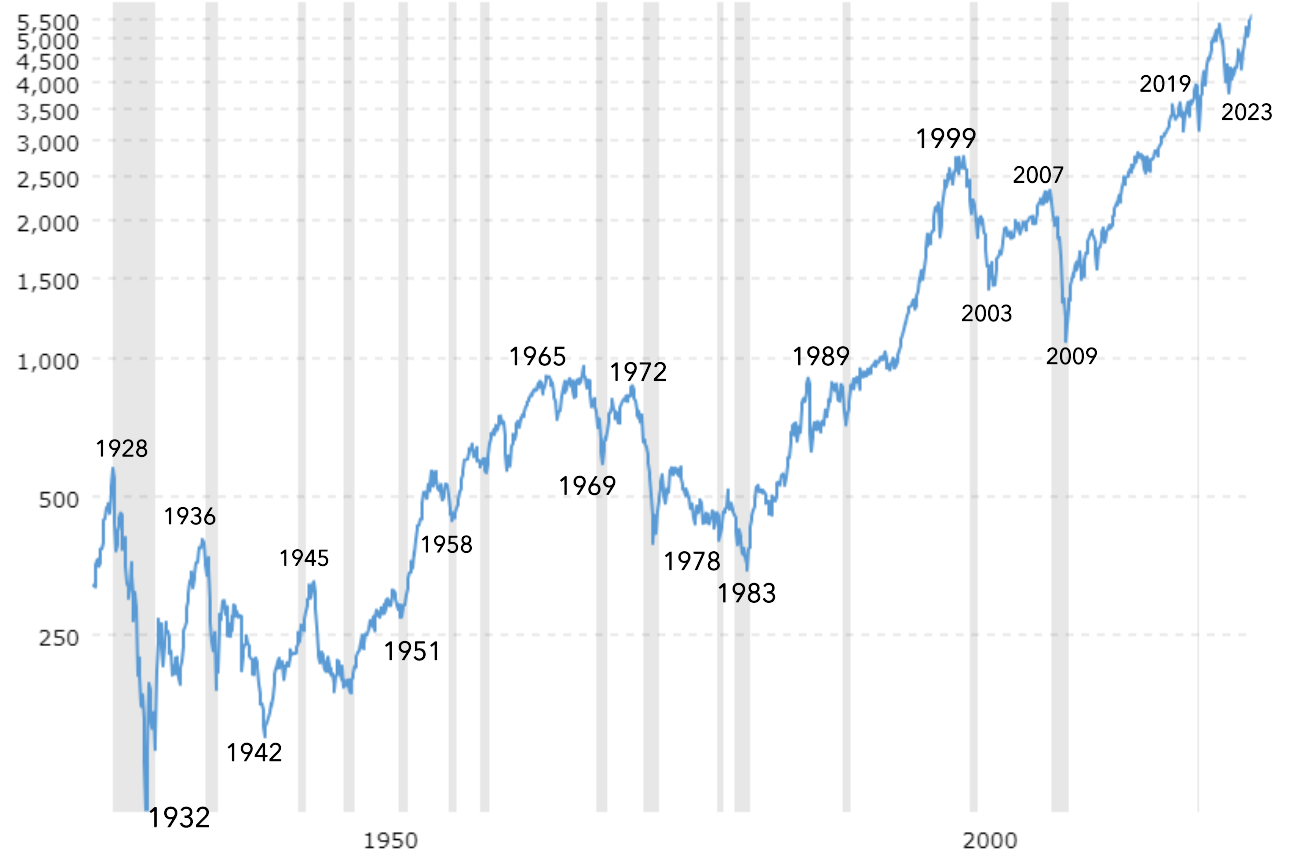

1st and 2nd images are S&P 500 (US economy), 3rd image is yield curve.