I have several stocks diversified over different industries in my portfolio although my diversification is very limited and should be called "focus investment". Diversification works, achieving satisfactory results over the long term by reducing risks, as described in the book "The Intelligent Investor by Benjamin Graham". He emphasizes the importance of spreading investments across various stocks and sectors to reduce risk. However, he also emphasizes that excessive diversification can hurt you more than having an adequate number of stocks in a portfolio. A portfolio of 10 to 30 is good, or rather around 15 different common stocks should be sufficient to optimize the purpose of diversification.

One of my stocks in the focus investment portfolio, I have POI (O: Unknown) stock. I started monitoring the stock around April and decided to purchase it at the beginning of August 2024. The first blog was posted on 8/14/2024 here.

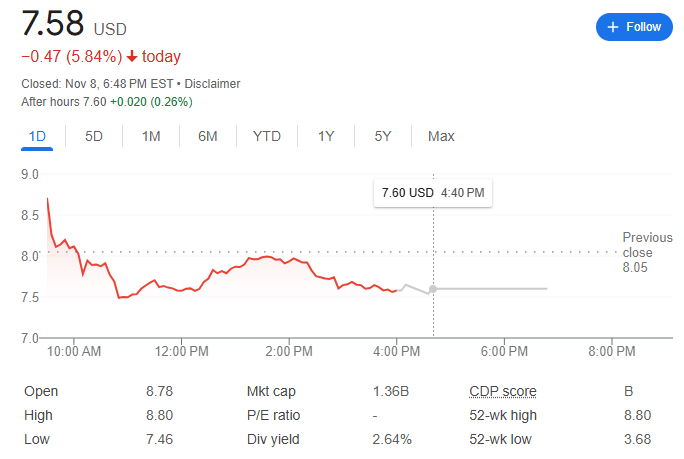

POI (Secret) Stock Is On The Rise

This is an American technology company founded on April 23, 1920, and making just over $3 billion in 2023. Currently, the market capital is around 1/3 of the annual revenue and started gaining momentum since the beginning of this year. I purchased the stock originally at $6.00 and accumulated when it dipped over the last three months. Yesterday, On 11/8/2024, the stock hit $8.80 and already providing more than 30% growth over 3 months. The closing price was $7.58. This is the update of my predicted stock which was indicated by my theory "Time Principals". The stock ticker is revealed to only paid individuals, however, I would like to disclose the info to anyone in public when the stock once hits around $14.