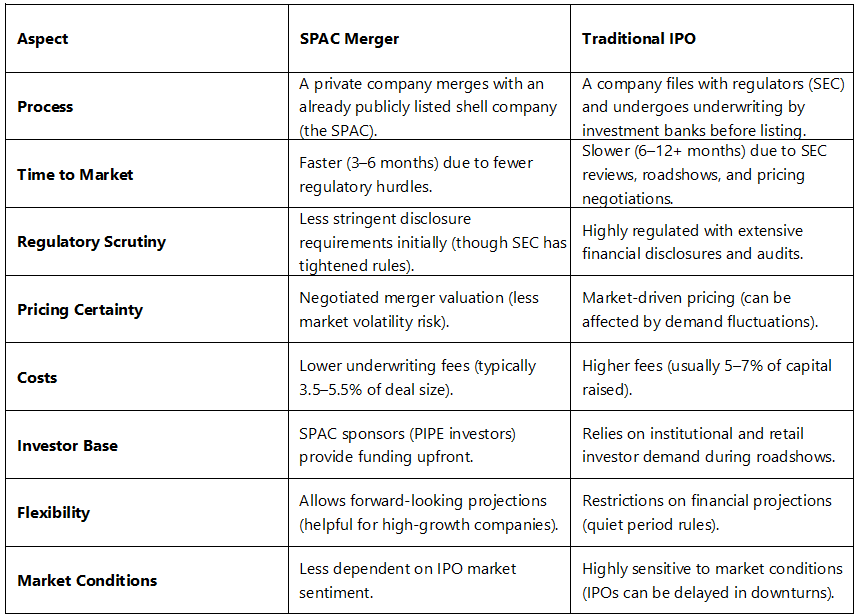

A SPAC merger (Special Purpose Acquisition Company) and an IPO (Initial Public Offering) are two different methods for a company to go public. Here are the key differences and why a SPAC merger can sometimes be more attractive than an IPO:

Why SPAC Mergers Can Be More Attractive Than IPOs

- Speed to Market

- SPAC mergers bypass the lengthy SEC review and roadshow process, allowing companies to go public in months instead of a year or more.

- Certainty of Valuation & Funding

- The deal price is negotiated in advance, reducing exposure to market volatility.

- SPACs often come with committed PIPE (Private Investment in Public Equity) financing, ensuring capital.

- Lower Regulatory Burden (Initially)

- While SPACs still require SEC filings, the process is less intensive than an IPO’s S-1 filing.

- Ability to Use Projections

- Unlike IPOs (where forward-looking statements are restricted), SPACs can use growth projections to attract investors.

- Better for High-Growth, Pre-Revenue Companies

- Startups and companies with uncertain cash flows (e.g., EV, biotech, space tech) prefer SPACs because traditional IPO investors may demand profitability.

- Avoids IPO Underpricing Risk

- Many IPOs leave money on the table due to mispricing (e.g., Airbnb, Snowflake surged post-IPO). SPACs allow negotiated pricing.

Downsides of SPACs (For Balance)

- Dilution: SPAC sponsors typically take 20% founder shares, diluting other investors.

- Scrutiny Rising: SEC has tightened SPAC accounting rules, making them less of a "shortcut."

- Reputation Risk: Some SPACs have underperformed post-merger (e.g., WeWork, Nikola).

Conclusion

SPAC mergers are attractive for companies that want speed, valuation certainty, and flexibility, especially in volatile markets. However, traditional IPOs remain preferable for established firms wanting broader investor trust and lower dilution.