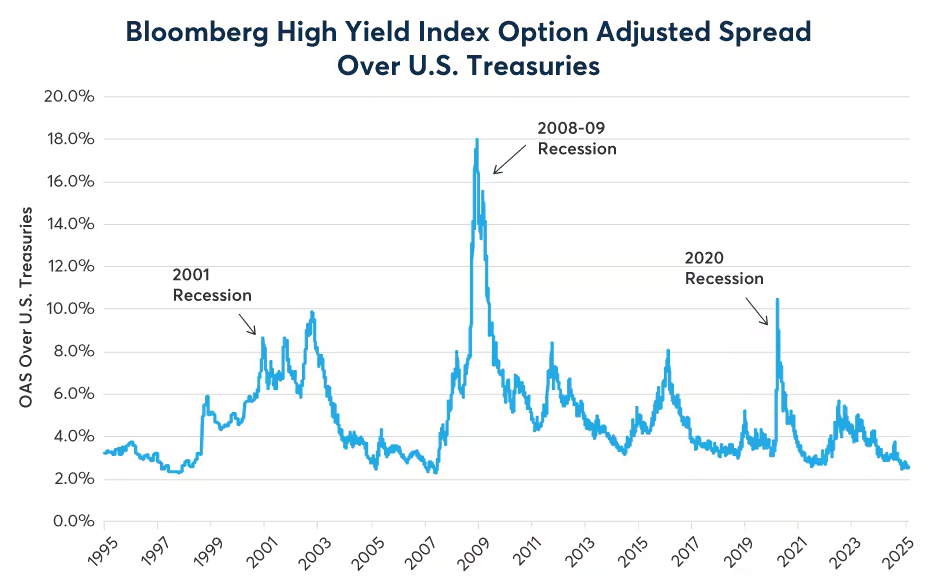

In late February, the Bloomberg High Yield Index Option Adjusted Spread (OAS) over U.S. Treasuries stood at 2.56%, hitting the narrowest level in history. The narrowest level seems to have been witnessed before the notorious recessions occurred in 1999, 2007, and 2019. The early 2000s recession, which ended in November 2001, was a period of economic downturn because of the collapse of the dot-com bubble. The Great Recession began in December 2007 until June 2009. The recession of 2020 was primarily driven by economic lockdown because of the widespread disruption of COVID-19.

source: Bloomberg Professional (LF98OAS)

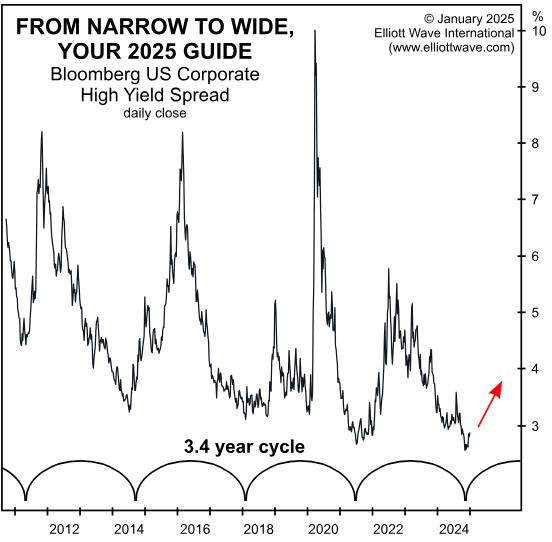

When the Bloomberg US Corporate High Yield (HY) Spread widens (becomes bigger), it typically signals increased risk aversion and credit stress in the market. This usually has a negative impact on the S&P 500 for several reasons:

1. Higher Risk Premium → Lower Equity Valuations

- A widening HY spread indicates that investors demand higher compensation for holding risky corporate debt.

- This often translates to higher discount rates for equities, lowering stock valuations (especially for highly leveraged companies).

- The S&P 500, which includes many large corporations, may see downward pressure as earnings multiples contract.

2. Economic Growth Concerns

- A rising HY spread suggests worsening credit conditions, which can foreshadow an economic slowdown or recession.

- If high-yield borrowers face higher refinancing costs, corporate earnings may weaken, hurting S&P 500 profitability.

3. Flight to Safety Hurts Equities

- When spreads widen, investors often shift from stocks to safer assets (Treasuries, gold, defensive sectors).

- This can lead to broad-based selling in the S&P 500, particularly in cyclical sectors (financials, energy, industrials).

<Gold > Investors are shifting from stocks to gold and driving the price of gold to rally from $2,000 to $3,200 in a year.

4. Liquidity & Financial Stress

- A sharply widening HY spread can indicate tightening financial conditions, making it harder for companies to borrow.

- This can lead to reduced buybacks, dividends, and capital expenditures—key drivers of S&P 500 performance.

Historical Correlation

- Historically, a significant widening in HY spreads (e.g., during 2008, 2011, 2015, 2020) has coincided with S&P 500 declines.

- Conversely, when spreads tighten, the S&P 500 tends to rally as confidence improves.

Exceptions & Nuances

- If the spread widens moderately due to temporary factors (e.g., Fed rate hikes without a recession), the S&P 500 may remain resilient.

- The Fed’s response matters—if central banks ease policy to offset credit stress, equities could recover quickly (e.g., 2019, 2020).

Bottom Line

A widening high-yield spread is generally bearish for the S&P 500, signaling higher credit risk and potential economic weakness. However, the magnitude and persistence of the move, along with Fed policy and economic data, determine the ultimate impact.