People want to be seen as independent. They talk like like an independent person and act like one. Needless to say, they don’t want to be seen as dependent. Let’s say living with parents after 25 years old because they want to save their money. I just want to think […]

Author: yosuke yamada

Type Of Investments 2

Continuation of the previous blog, Types of Investment 1. There are 16 different types of investment vehicles introduced. However, which investments are better than the others, which investment may not be good for you? I would like to cover Pros and Cons of each investment differences but let’s focus on […]

Types Of Investments 1

The first thing people get really confused with investment is that there are so many different types of invest out there and people don’t really know which one to choose. Some people may say “Real Estate is the best investment’ and another say ” Mutual funds are the best investment”, […]

Is Your Money Safe At Your Bank?

Keeping your money in a safe place would give you at ease without a doubt. Have you ever wondered how safe it is to leave your money at a bank, which most people do? How about Bank of America, Chase, Fells Fargo, CitiBank and etc? What if the economy face to […]

How Tax And Inflation Affect On Your Money

This was posted earlier and people left so many comments on it, so reposting it. Do you know how much you should save money for your future? You may be satisfied with saving your money at a bank. Well, let me ask you this. You are letting a bank borrow […]

Successful Business Models To Plan With

Have you ever seen many business owners taking their time whenever they like for family and vacations? Have you seen many business owners having a good lifestyle? They are all business owners. Building a business may not be easy because there is no one else to tells you what to […]

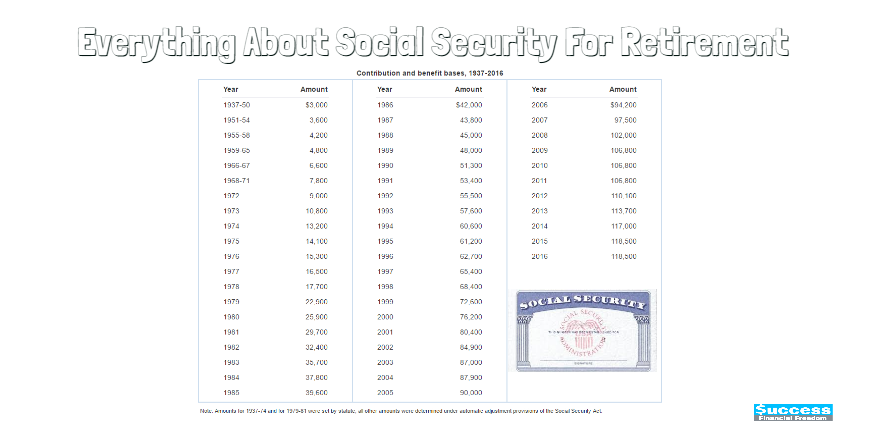

Everything About Social Security For Retirement

We pay for Social Security Benefits from every paycheck you work for. This is what government does and how they tax you from your paycheck. Please make sure to get Social Security Benefits as much as possible. 1. Social Security tax wage limit: $118,500 People pay 6.2% of their earnings […]

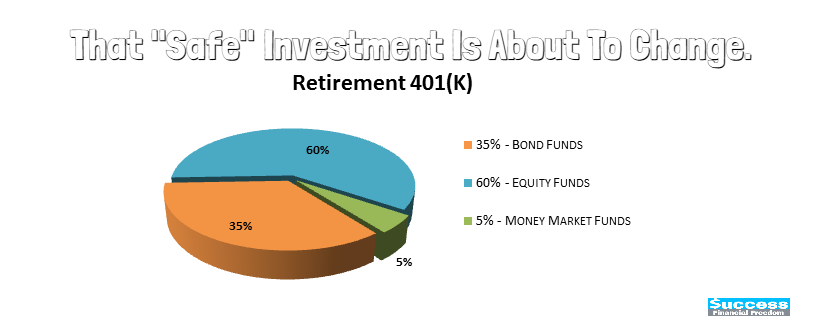

That “Safe” Investment Is About To Change.

If there is a flaw in your retirement investment, it has to change to come up with a solution. 401(K) has been known as “Safe” investment many participants can rely on for the income in their retirement. 401(K) has been managed in money-market funds and other funds and act as […]

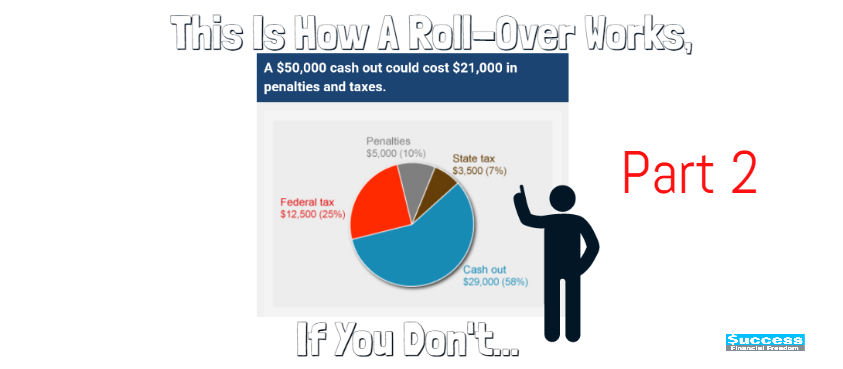

How A Roll-Over Works? 2

Here is the continuation of “How a roll –over works 1”, the previous blog talks about what a roll over is and what type of roll-over exists and also the options of 401(k) and 403(B)roll-over. It may not be easy to understand right away for beginners but identifying your retirement […]

How A Roll-Over Works? 1

Understanding how roll-over works and do a right roll-over separates you from financial literacy from financial illiteracy. If you are financial literacy, you will be able to make a good decision at the right timing to keep your money grow otherwise, you lose. Rolling over is a very critical thing […]