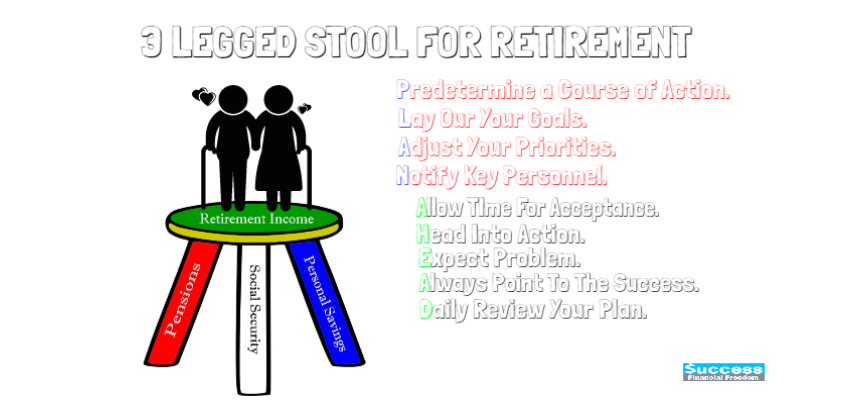

The three-legged stool is an investment terminology used for retirement. Many financial advisers use that to describe the three important sources of retirement income for retirees. -Social Security, employee pensions, and personal savings. The structure of 3 legged Stool has changed dramatically last two decades. First of all, the pension […]

Investment/Trade

Einstein’s Rule of 72

The rule of 72 is a simple equation created by Albert Einstein. He said that compounding interest is the eighth wonder of the world.It is the most powerful math equation. It is one of the simplest tools to help you calculate the estimate of accumulating wealth for how long it […]

Variable Universal Life Insurance(VUL)

It is one of permanent life insurances that offers both a death benefit and an investment feature. The excess of premium payments above the current cost of insurance is invested and its return will be credited to the cash value of the policy. The cash value is credited each month […]

Fixed Universal Life Insurance

It is confusing that there are many different types of life insurances and people don’t really know which one to pick. Many don’t want to even think about the difference, then ended up getting the cheapest life insurance, term life insurance. I would like to explain the concept and benefits […]

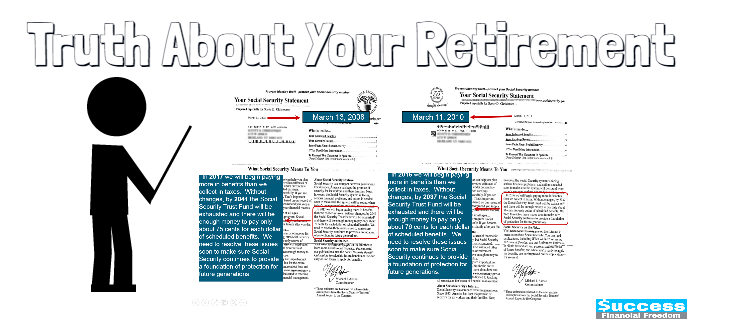

How Much Do I Get From Social Security

The very first thing what I would like to do is to give you this www.ssa.gov. Please check your Social Security earnings and see an estimate of your benefits on the Web site. Social Security was established in1935, It has been feeding elderly with a steady income for their retirement. […]

A Proven Investment To Secure Your Retirement, Annuity

One of the financial products, annuity, an annuity is a contract between you and an insurance company in which you make a lump-sum payment or series of payments. Of course, the more you contribute, the higher you can grow money. In many cases, people grow their money in IRA, 401(K), […]

You Get What You Paid For, Active management & Passive management Investment

This is the insider information, not many people are aware of the existence of Active management and Passive management. These are investment strategies that can be used to generate a return on people’s investment accounts. They differ in how the account manager approaches in the portfolio over time. Basically, Active […]

Types of retirement plan(IRA and 401(K))

From the previous blog, you got the idea of how IRA and Roth IRA work, right? Those are both individual retirement account. How about 401(k)? This is also well known a retirement investment plan. If you work for prestigious corporations and a decent size of a corporation, you should be […]

Types of Retirement Plans (IRA and Roth IRA)

A retirement plan is a type of investment. Investment plans are differentiated by the tax code, requirement and distribution . Most people struggle with choosing the best investment vehicle for their retirement because every situation is different. The difference in income, whether they own a business or not. This blog will differentiate […]

Baby-Boomers, 23.4 % Of U.S. Population, Are In Troble

The big crisis in retirement has come and expected to continue for next 25 years. This topic cannot be taken lightly because it is highly correlated with your mother or father or your friends. People who are called baby-boomers are retiring one after the other every 7 seconds now. It is […]