This is one the popular ways to look at a chart as a technical analysis. The wave principle was discovered by Ralph Nelson Elliott, which describes social, or crowd, behavior trends and reverses in recognizable patterns. He used stock market data as his main research tool and isolated thirteen patterns of movement or waves. The interesting is that this movement recurs in market price data, he named, defined and illustrated how these structures link together to form a larger version of those same patterns. Elliott wave principle is a catalog of price patterns and an explanation of where these forms are likely to occur in the overall path of market development.

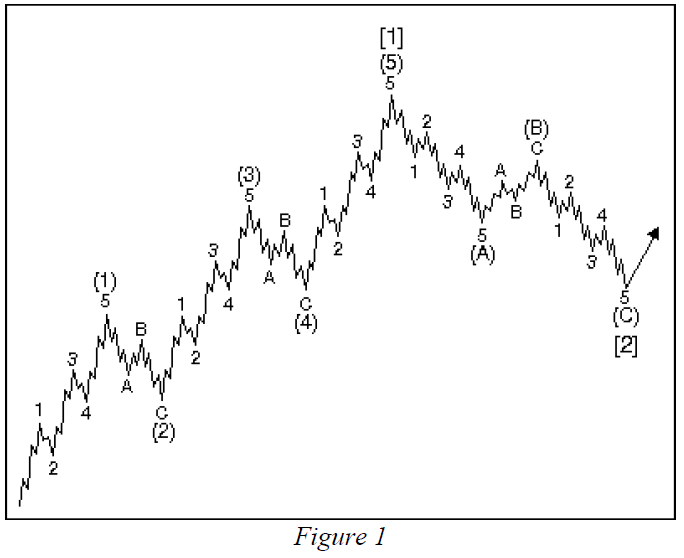

The basic pattern Elliot described consists of impulsive waves (denoted by numbers) and corrective waves (denoted by letters). An impulsive wave is composed of five sub-waves and moves in the same direction as the trend of the next larger size. A correct wave is composed of three subways and moves against the trend of the next larger size. As Figure 1 shows, these basic patterns link to form five- and three-wave structures of increasingly larger size.

The first small sequence is an impulsive wave ending at the peak labeled 1. It also signals the start of a three-wave corrective sequence, labeled wave 2. Wave 3,4 and 5 complete a larger impulsive sequence, label wave (1).

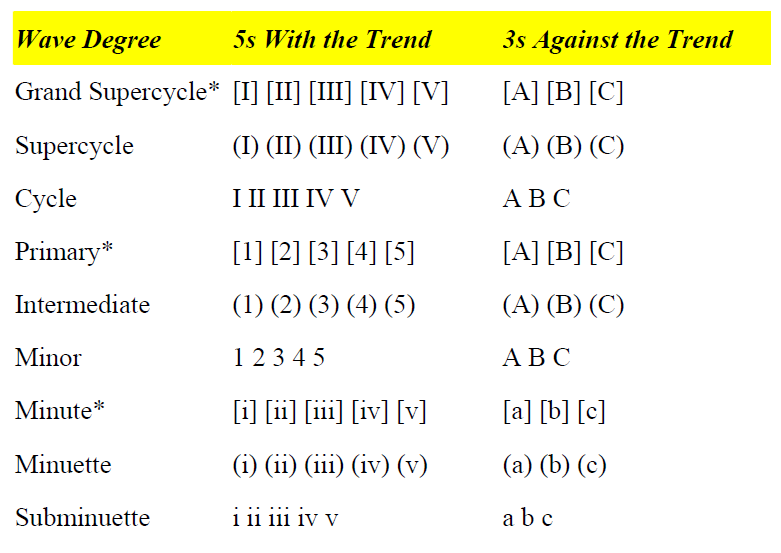

The correction, wave (2), is followed by waves (3), (4) and (5) to complete an impulsive sequence of the next larger degree, labeled wave [1]. After the completion of wave [1], a three-wave correction of the same degree occurs, labeled wave [2]. Here is the accepted notations for labeling Elliot Wave Patterns at every degree of trend.

Within a corrective wave, waves A and C may be smaller-degree impulsive waves, consisting of five sub waves. This is because they move in the same direction as the next larger trend, i.e., waves (2) and (4) in the illustration. Wave B, however, is always a corrective wave, consisting of three subways, because it moves against the larger downtrend.

Within impulsive waves, one of the odd-numbered waves (usually wave three) is typically longer than the other two.

Application

The practical goal of any analytical method is to identify market lows suitable for buying (covering shorts), and market highs suitable for selling (or selling short). I personally happened to find that Elliot Wave principle is the best principle to be utilized for those functions. However, the Wave Principle does not provide certainty about any one market outcome. It rather provides an objective means of assessing the relative probabilities of possible future paths for the market. At any time, two or more valid wave interpretations are usually acceptable by the rules of the Wave Principles.

What the Wave Principles says is that mankind's progress does not occur in a straight line, does not occur randomly, and does not occur cyclically. Rather, progress takes place in a "three steps forward, and two steps back" fashion, a form that nature prefers. As a corollary, the Wave Principle reveals that periods of setback, in fact, are a requisite for social (perhaps even individual) progress.