Here is the animation of 32 years’ worth of Treasury Yield Curve

Business Insider reader Jim Laird created this animated chart tracking Treasury yield curves compared to the actual yield on a three-month Treasury.

The yield curve is a line that plots a set of forward-looking interest rates at a given point in time. A US Treasury yield curve would connect today’s yields for three-month, six-month, 12-month, two-year, five-year, one-year, and 30-year Treasury securities.

“I wrote a script that figured out the yield curve at every date from 1982 to present and compared the results to the actual yield on a three-month Treasury,” Laird said. “Then I turned it into a movie. The red parts are overestimating, the blue are underestimates.”

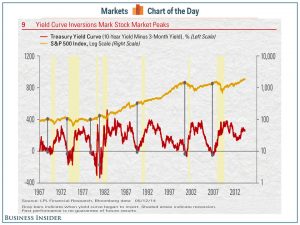

An inverted yield curve, when long-term yields are lower than short-term yields, has a long track record of occurring before recessions.

There are very few market indicators that can predict recessions without sending out false positives.

The yield curve is one of them. The yield curve inverted just prior to every U.S. recession in the past 50 years.

“That is seven out of seven times — a perfect forecasting track record,” he reiterated.

The yield curve is inverted when short-term interest rates (e.g. the 3-year Treasury) are higher than long-term interest rates (e.g. the 10-year Treasury yield).

According to Kleintop, “The yield curve inversion usually takes place about 12 months before the start of the recession, but the lead time ranges from about 5 to 16 months,” “The peak in the stock market comes around the time of the yield curve inversion, ahead of the recession and accompanying downturn in corporate profits.”

The Federal Reserve has been signaling that tighter monetary policy is on its way, which means short-term interest rates should move higher.

Is this something we should be worried about? Kleintop offered some context:

How far the Fed must push up short-term rates before the yield curve inverts by 0.5% depends on where long-term rates are. Even if long-term rates stay at the very low yield of 2.6% seen in mid-June 2014, to invert the yield curve by 0.5% the Fed would need to hike short-term rates from around zero to more than 3%. Based on the latest survey of current Fed members that vote on rate hikes, they do not expect to raise rates above 3% until sometime in 2017, at the earliest…